Table of Contents

ToggleHave you ever imagined receiving free money to save? Sounds too good to be true. But that’s precisely what the Lifetime ISA (LISA) offers. If you’re confused about how LISAs work, you’re not alone. Let’s dive in together and unravel this powerful savings tool step-by-step.

Watch this short video to see how a Lifetime ISA works and why it could be a great savings option for you.

A Story About Cassy: Your LISA Journey Begins

Meet Cassy, a 27-year-old graphic designer from Manchester. Like many young professionals, Cassy dreams of owning her first home and having a comfortable retirement. She heard about Lifetime ISA from her friends, a savings account that offers a 25% government bonus on contributions, but she wasn’t sure how it worked or if it was right for her.

Do you think this sounds familiar to you? Let’s follow Cassy’s journey as she explores the LISA and learns how it can help her achieve her financial goals, and how it could help yours, too.

What Exactly Is a Lifetime ISA (LISA)?

A Lifetime ISA (LISA) is a type of Individual Savings Account introduced by the UK government to provide a secure and effective way for people to save for two significant life goals: buying a first home or saving for retirement.

Here’s the exciting part: For every £4 you save, the government generously adds £1 as a bonus—an impressive 25% boost to your savings every year!

The Two Types of Lifetime ISAs

Emma quickly learned there are two main types of Lifetime ISAs:

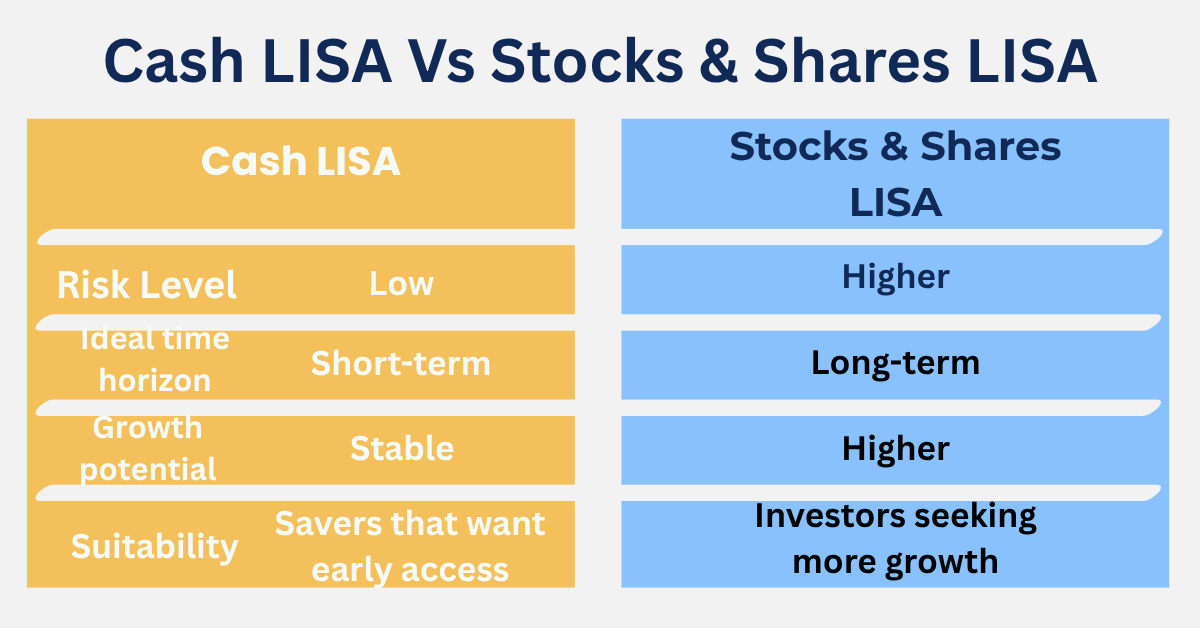

Cash Lifetime ISA: A secure option that guarantees your savings will steadily grow with interest, making it an ideal choice for those who prefer a low-risk investment or have a short time frame.

Stocks & Shares Lifetime ISA: This ISA offers potentially higher returns by investing in the stock market, though it carries higher risks.

Emma opted for a Stocks & Shares LISA because she’s comfortable with risk and eager to maximise growth over the long term. This decision aligns with her financial goals and risk tolerance.

Cash vs Stocks & Shares LISA: Which Should You Choose?

Choosing between a Cash LISA and a Stocks & Shares LISA depends on several factors:

Consider a Cash LISA if:

You prefer low-risk, stable returns.

You’re planning to buy your home within the next few years.

Pros: Stability, guaranteed interest, suitable for short-term goals.

Cons: Lower returns, might not keep pace with inflation.

Consider a Stocks & Shares LISA if:

You have a higher risk tolerance.

Your financial goals are long-term (5+ years).

Pros: Potentially higher returns, suitable for long-term investing.

Cons: Market fluctuations and the risk of losing value in the short term.

Cassy chose Stocks & Shares as she’s investing for a goal 5+ years away.

For a deeper dive into ISAs:

Platforms Offering Lifetime ISAs

Choosing the right platform for your LISA is essential. Here are some popular options:

Cash Lifetime ISA Providers

Moneybox: Simple app-based saving; competitive interest rates; minimal fees.

Skipton Building Society: Offers a reliable cash LISA with no monthly fees and stable interest rates.

Stocks & Shares Lifetime ISA Providers

AJ Bell Youinvest: Low platform fee (typically 0.25%), broad range of investment options.

Hargreaves Lansdown: User-friendly, extensive educational resources, slightly higher fees (0.45%).

Nutmeg: Robo-adviser, easy to use, fees around 0.45%-0.75%.

Eligibility and Important Rules for LISA

Wondering if you’re eligible? Emma was too! Here’s what she found:

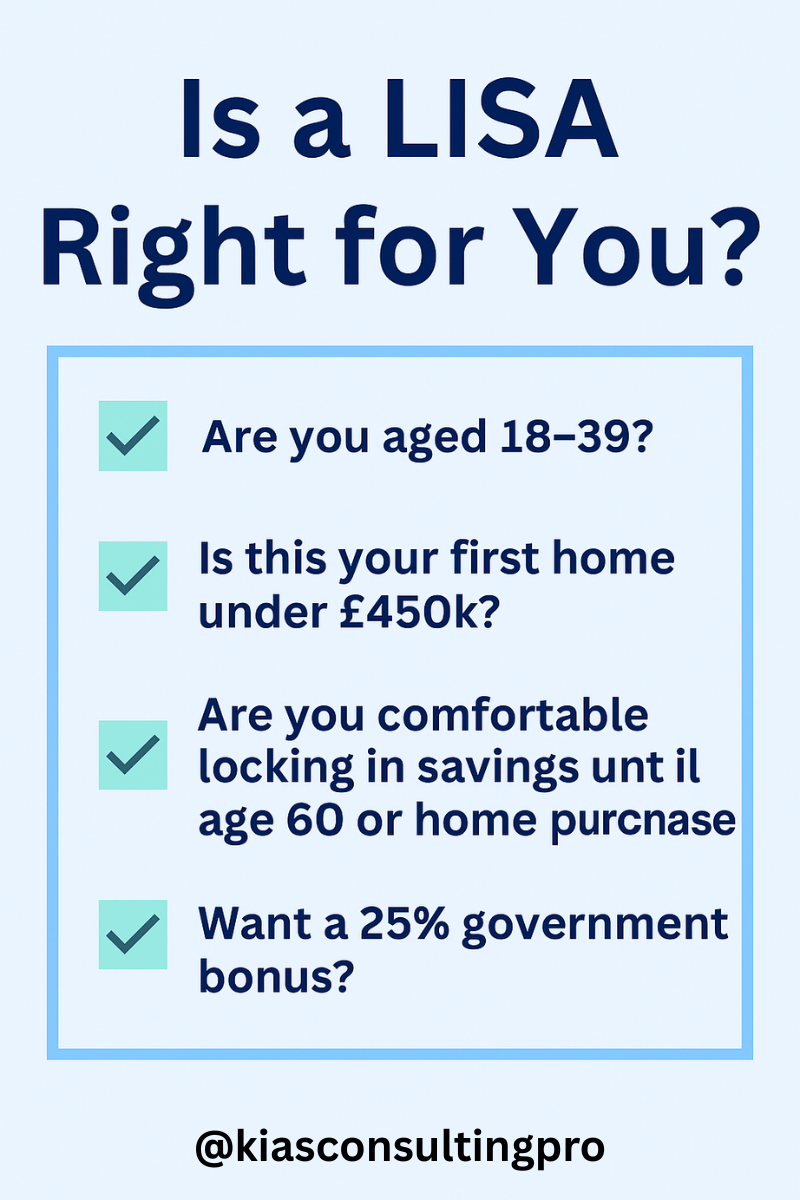

Age Requirements: You must be between 18 and 39 to open a LISA.

Annual Contribution Limit: With a LISA, you can contribute up to £4,000 per tax year, which means you could receive a maximum £1,000 government bonus annually, a great benefit to consider.

Bonus and Withdrawals: Funds can be withdrawn penalty-free when buying your first home (valued under £450,000) or after turning 60.

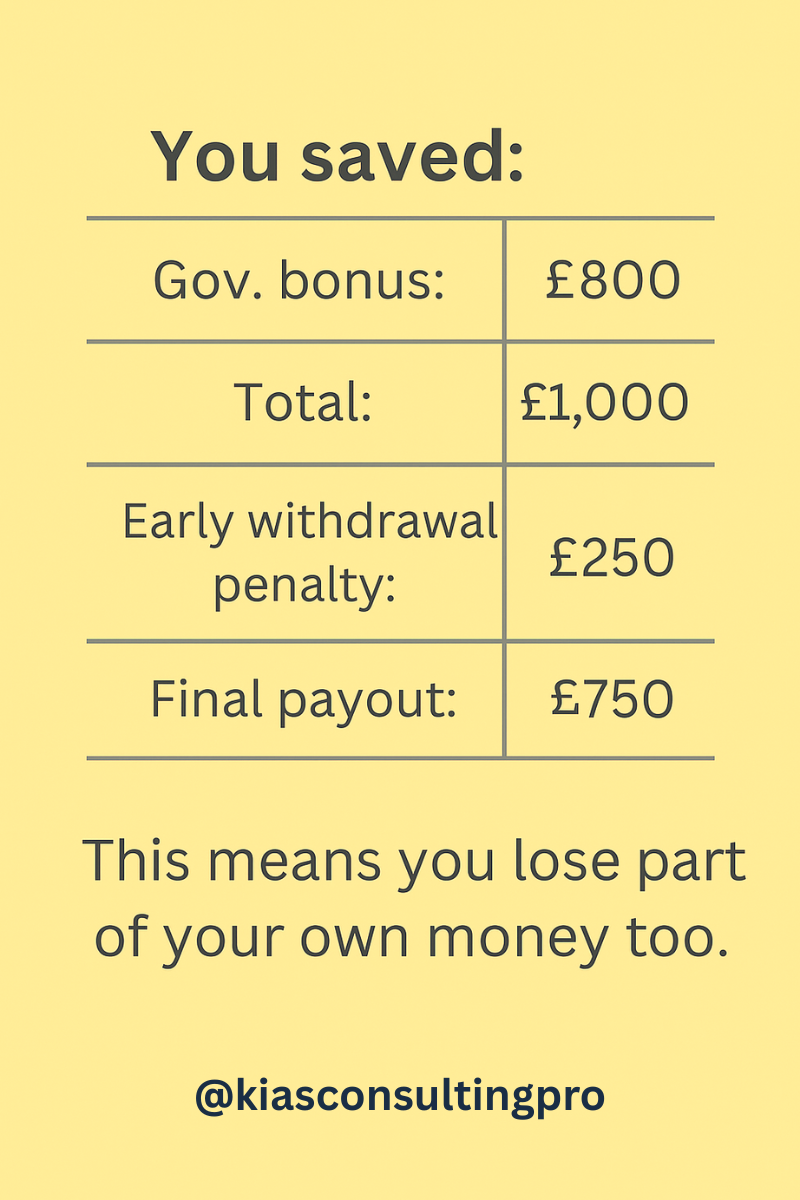

Early Withdrawal Penalty: It’s important to note that taking money out for any other reason incurs a penalty of 25%, so it’s best to adhere to the rules as if you withdraw for anything other than purchasing your first home or before the age of 60, the penalty is not only on the amount you have contributed but also on interest accrued.

Example: If you saved £800 and received a £200 bonus, your total balance would be £1,000. If you withdraw early, a 25% penalty applies to the full £1,000 — that’s £250. You would only get £750 back, meaning you lose the bonus and £50 of your contributions.

How Cassy Plans to Use Her LISA

Emma opened her LISA at age 27, saving £4,000 annually, earning a £1,000 bonus yearly. In five years, she’ll have £25,000, boosting her home deposit.

If you’re looking to boost your savings further, check out:

Is a LISA Right for You?

Cassy found a LISA that perfectly suited her goal of homeownership. A LISA could be ideal if you aim to buy your first home or save effectively for retirement.

Consider your circumstances, risk tolerance, and goals. If this feels overwhelming, remember, you’re not alone. We’re here to support you every step of the way. Our mission at KIAS Consulting Pro is to empower as many people as possible to take control of their finances. There’s really no excuse not to take advantage of this incredible offer!

Ready to Open Your LISA?

Emma took control of her future with a Lifetime ISA, and so can you. Starting your LISA journey early can make a huge difference.

Trusted Resources:

Frequently Asked Questions (FAQs):

1. Can I have both a Lifetime ISA and a Help to Buy ISA?

Yes, you can have both, but you can only use the government bonus from one ISA toward purchasing your first home.

2. What happens if I withdraw money from my LISA early?

You’ll incur a 25% penalty on the amount withdrawn, losing the bonus plus an additional portion of your savings.

3. Can I transfer my Cash LISA to a Stocks & Shares LISA, or vice versa?

Yes, you can transfer between providers and types without losing your bonus, but ensure it’s done through the new provider directly.

4. What if my first home costs more than £450,000?

You won’t be able to use your LISA savings without penalty. Consider this carefully when planning your home purchase.

5. Can I open a Lifetime ISA after age 40?

No, you must open your LISA before turning 40. However, you can continue contributing until age 50.

Next Up: Stay tuned for our next blog, “How to Use a Lifetime ISA (LISA) to Buy Your First Home in the UK,” which includes differences from the Help to Buy ISA.

If this feels overwhelming, remember, you’re not alone. With the proper support, you can manage your finances. Our mission at KIAS Consulting Pro is to empower as many people as possible to take control of their finances.

Ready to get started? Take advantage of our free consultation, a valuable opportunity to kickstart your financial journey.

Subscribe below so you don’t miss future posts!

Capital Gains Tax UK: How Much Will You Pay When You Sell an Asset?

Capital Gains Tax can apply when you sell property, shares, or crypto in the UK. This guide explains how CGT works and helps you estimate what you might owe before you sell.

How to Build Your Credit Score in the UK (2026): Cards, Apps & Smart Money Habits

A practical 2026 guide on how to build your credit score in the UK using credit cards, apps and smart money habits, without damaging your finances.

Investment Fees Explained: The Real Cost of Investing (and How to Pay Less in 2025)

Investment fees can quietly shrink your long-term returns. This simple UK guide explains the main types of fees, how they affect your portfolio, and practical ways to reduce costs in 2025 so more of your money stays invested for your future.

FSCS Protection UK: How to Keep Your Money Safe in 2025

FSCS protection in the UK is changing from 1 December 2025. The standard deposit limit will rise from £85,000 to £120,000, and temporary high balances will be protected up to £1.4 million. This guide explains how the new limits work and how to keep your money safe across banks, savings apps and investment platforms.

How to Budget for Christmas Gifts Without Overspending (UK 2025 Guide)

Christmas is one of the most expensive times of the year, but overspending doesn’t have to be your story. This guide shows you how to budget for Christmas gifts in the UK, use cashback and discounted gift cards, avoid borrowing, and give meaningfully without going broke. Practical, simple, and perfect for helping you stay debt-free this festive season.

Achieve Financial Independence in the UK: 7 Proven Tips (Plus a Mortgage Strategy That Works in 2025)

Practical, UK-focused financial independence tips for 2025. Learn how to budget, invest, and build multiple income streams to achieve lasting financial freedom.