Table of Contents

ToggleHave you ever imagined receiving free money to save? Sounds too good to be true. But that’s precisely what the Lifetime ISA (LISA) offers. If you’re confused about how LISAs work, you’re not alone. Let’s dive in together and unravel this powerful savings tool step-by-step.

Watch this short video to see how a Lifetime ISA works and why it could be a great savings option for you.

A Story About Cassy: Your LISA Journey Begins

Meet Cassy, a 27-year-old graphic designer from Manchester. Like many young professionals, Cassy dreams of owning her first home and having a comfortable retirement. She heard about Lifetime ISA from her friends, a savings account that offers a 25% government bonus on contributions, but she wasn’t sure how it worked or if it was right for her.

Do you think this sounds familiar to you? Let’s follow Cassy’s journey as she explores the LISA and learns how it can help her achieve her financial goals, and how it could help yours, too.

What Exactly Is a Lifetime ISA (LISA)?

A Lifetime ISA (LISA) is a type of Individual Savings Account introduced by the UK government to provide a secure and effective way for people to save for two significant life goals: buying a first home or saving for retirement.

Here’s the exciting part: For every £4 you save, the government generously adds £1 as a bonus—an impressive 25% boost to your savings every year!

The Two Types of Lifetime ISAs

Emma quickly learned there are two main types of Lifetime ISAs:

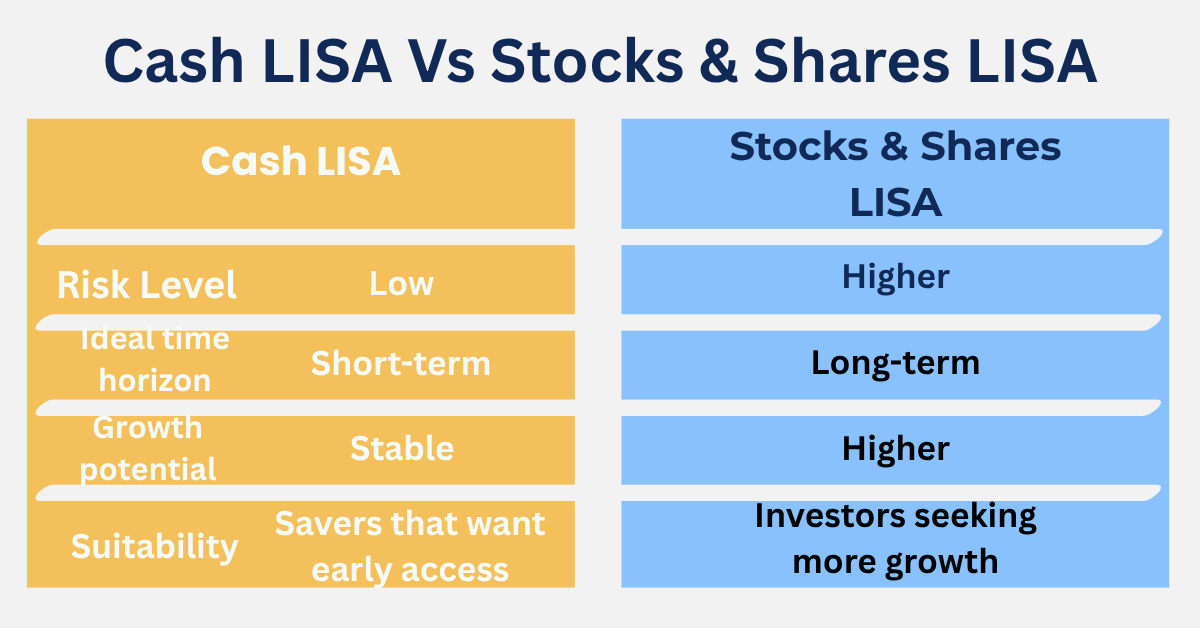

Cash Lifetime ISA: A secure option that guarantees your savings will steadily grow with interest, making it an ideal choice for those who prefer a low-risk investment or have a short time frame.

Stocks & Shares Lifetime ISA: This ISA offers potentially higher returns by investing in the stock market, though it carries higher risks.

Emma opted for a Stocks & Shares LISA because she’s comfortable with risk and eager to maximise growth over the long term. This decision aligns with her financial goals and risk tolerance.

Cash vs Stocks & Shares LISA: Which Should You Choose?

Choosing between a Cash LISA and a Stocks & Shares LISA depends on several factors:

Consider a Cash LISA if:

You prefer low-risk, stable returns.

You’re planning to buy your home within the next few years.

Pros: Stability, guaranteed interest, suitable for short-term goals.

Cons: Lower returns, might not keep pace with inflation.

Consider a Stocks & Shares LISA if:

You have a higher risk tolerance.

Your financial goals are long-term (5+ years).

Pros: Potentially higher returns, suitable for long-term investing.

Cons: Market fluctuations and the risk of losing value in the short term.

Cassy chose Stocks & Shares as she’s investing for a goal 5+ years away.

For a deeper dive into ISAs:

Platforms Offering Lifetime ISAs

Choosing the right platform for your LISA is essential. Here are some popular options:

Cash Lifetime ISA Providers

Moneybox: Simple app-based saving; competitive interest rates; minimal fees.

Skipton Building Society: Offers a reliable cash LISA with no monthly fees and stable interest rates.

Stocks & Shares Lifetime ISA Providers

AJ Bell Youinvest: Low platform fee (typically 0.25%), broad range of investment options.

Hargreaves Lansdown: User-friendly, extensive educational resources, slightly higher fees (0.45%).

Nutmeg: Robo-adviser, easy to use, fees around 0.45%-0.75%.

Eligibility and Important Rules for LISA

Wondering if you’re eligible? Emma was too! Here’s what she found:

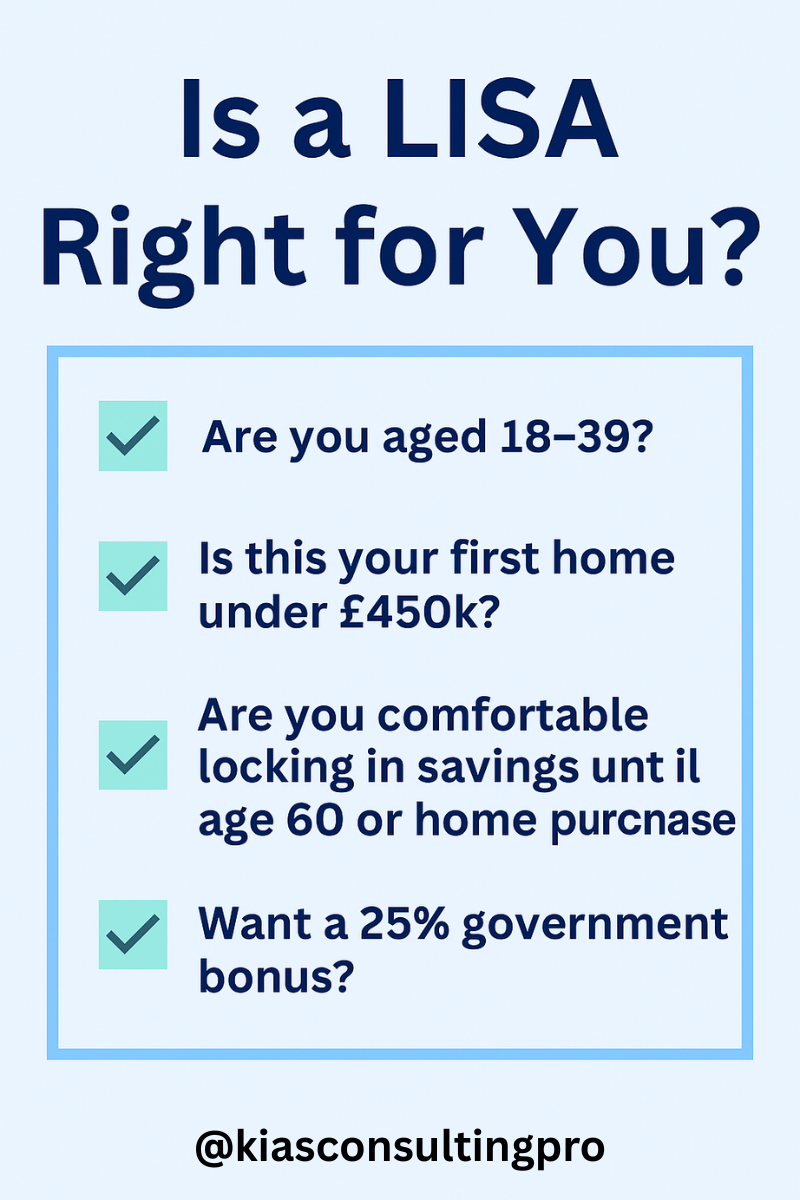

Age Requirements: You must be between 18 and 39 to open a LISA.

Annual Contribution Limit: With a LISA, you can contribute up to £4,000 per tax year, which means you could receive a maximum £1,000 government bonus annually, a great benefit to consider.

Bonus and Withdrawals: Funds can be withdrawn penalty-free when buying your first home (valued under £450,000) or after turning 60.

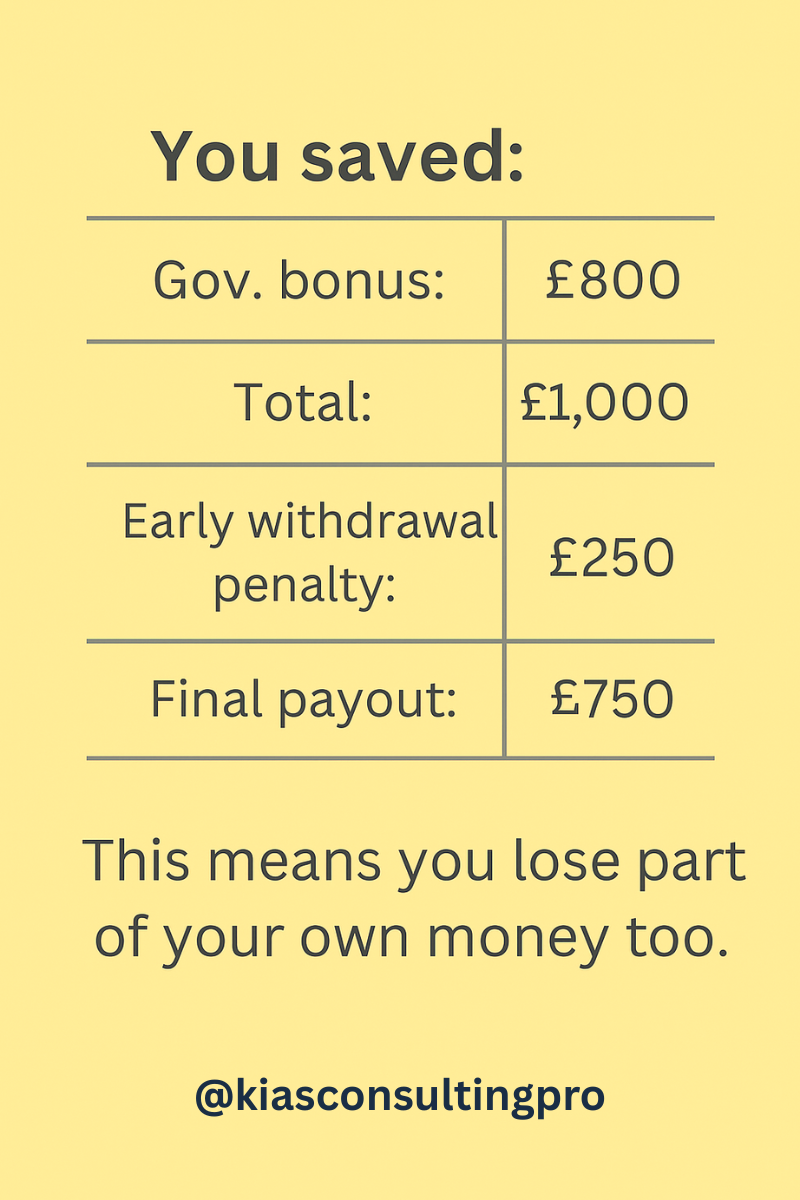

Early Withdrawal Penalty: It’s important to note that taking money out for any other reason incurs a penalty of 25%, so it’s best to adhere to the rules as if you withdraw for anything other than purchasing your first home or before the age of 60, the penalty is not only on the amount you have contributed but also on interest accrued.

Example: If you saved £800 and received a £200 bonus, your total balance would be £1,000. If you withdraw early, a 25% penalty applies to the full £1,000 — that’s £250. You would only get £750 back, meaning you lose the bonus and £50 of your contributions.

How Cassy Plans to Use Her LISA

Emma opened her LISA at age 27, saving £4,000 annually, earning a £1,000 bonus yearly. In five years, she’ll have £25,000, boosting her home deposit.

If you’re looking to boost your savings further, check out:

Is a LISA Right for You?

Cassy found a LISA that perfectly suited her goal of homeownership. A LISA could be ideal if you aim to buy your first home or save effectively for retirement.

Consider your circumstances, risk tolerance, and goals. If this feels overwhelming, remember, you’re not alone. We’re here to support you every step of the way. Our mission at KIAS Consulting Pro is to empower as many people as possible to take control of their finances. There’s really no excuse not to take advantage of this incredible offer!

Ready to Open Your LISA?

Emma took control of her future with a Lifetime ISA, and so can you. Starting your LISA journey early can make a huge difference.

Trusted Resources:

Frequently Asked Questions (FAQs):

1. Can I have both a Lifetime ISA and a Help to Buy ISA?

Yes, you can have both, but you can only use the government bonus from one ISA toward purchasing your first home.

2. What happens if I withdraw money from my LISA early?

You’ll incur a 25% penalty on the amount withdrawn, losing the bonus plus an additional portion of your savings.

3. Can I transfer my Cash LISA to a Stocks & Shares LISA, or vice versa?

Yes, you can transfer between providers and types without losing your bonus, but ensure it’s done through the new provider directly.

4. What if my first home costs more than £450,000?

You won’t be able to use your LISA savings without penalty. Consider this carefully when planning your home purchase.

5. Can I open a Lifetime ISA after age 40?

No, you must open your LISA before turning 40. However, you can continue contributing until age 50.

Next Up: Stay tuned for our next blog, “How to Use a Lifetime ISA (LISA) to Buy Your First Home in the UK,” which includes differences from the Help to Buy ISA.

If this feels overwhelming, remember, you’re not alone. With the proper support, you can manage your finances. Our mission at KIAS Consulting Pro is to empower as many people as possible to take control of their finances.

Ready to get started? Take advantage of our free consultation, a valuable opportunity to kickstart your financial journey.

Subscribe below so you don’t miss future posts!

Master Your Money in 2025: A Complete Guide to Budgeting and the Best Tools That Actually Work

Find the best budgeting tools and planners to master your money in 2025. Learn how to create a budget that works for you using digital planners, binders, and smart budgeting systems.

The Truth About InvestEngine – My UK Review After 1 Year (2025)

I transferred my Vanguard SIPP to InvestEngine – and it wasn’t smooth sailing. Here’s my honest 2025 review of the platform after a full year of use, including why I’m giving them a second chance.

The Ultimate List of 7 Best Investing Books for Beginners (2025 Edition)

Discover the best investing books for beginners in 2025, seven timeless reads that simplify wealth-building, explain core investing principles, and help you start your journey toward financial independence with confidence.

How to Raise a Complaint to the UK Financial Ombudsman (With Real-Life Example)

I raised a complaint with the UK Financial Ombudsman when my SIPP transfer went wrong, and won. Here’s what happened, how the process works, and how to raise your own complaint with confidence.

The Smart Investor’s Secret: How ISAs Can Grow Your Wealth Tax-Free

ISAs remain one of the UK’s best-kept tax-free saving secrets. Discover how ISAs can grow your wealth tax-free and why starting early gives your money more time to compound. Whether you prefer saving or investing, learn how to make the most of your ISA in 2025 and beyond.

How to Switch Bank Accounts Safely (CASS Explained)

Want to switch bank accounts in the UK without stress? Learn how CASS works step-by-step, the protections built in, and smart tips to avoid mistakes.