Congratulations on nearing retirement! Whether you are close to retiring or planning to ensure a comfortable future, now is the perfect time to learn how to access your pension funds efficiently while minimising taxes. In this final guide of our UK Pension Series, we will clarify the process of pension withdrawals in the UK, outline the tax implications, and highlight common pitfalls to avoid. This guide will empower you with the knowledge you need to make informed decisions about your retirement.

Table of Contents

ToggleYour Pension Withdrawal Options

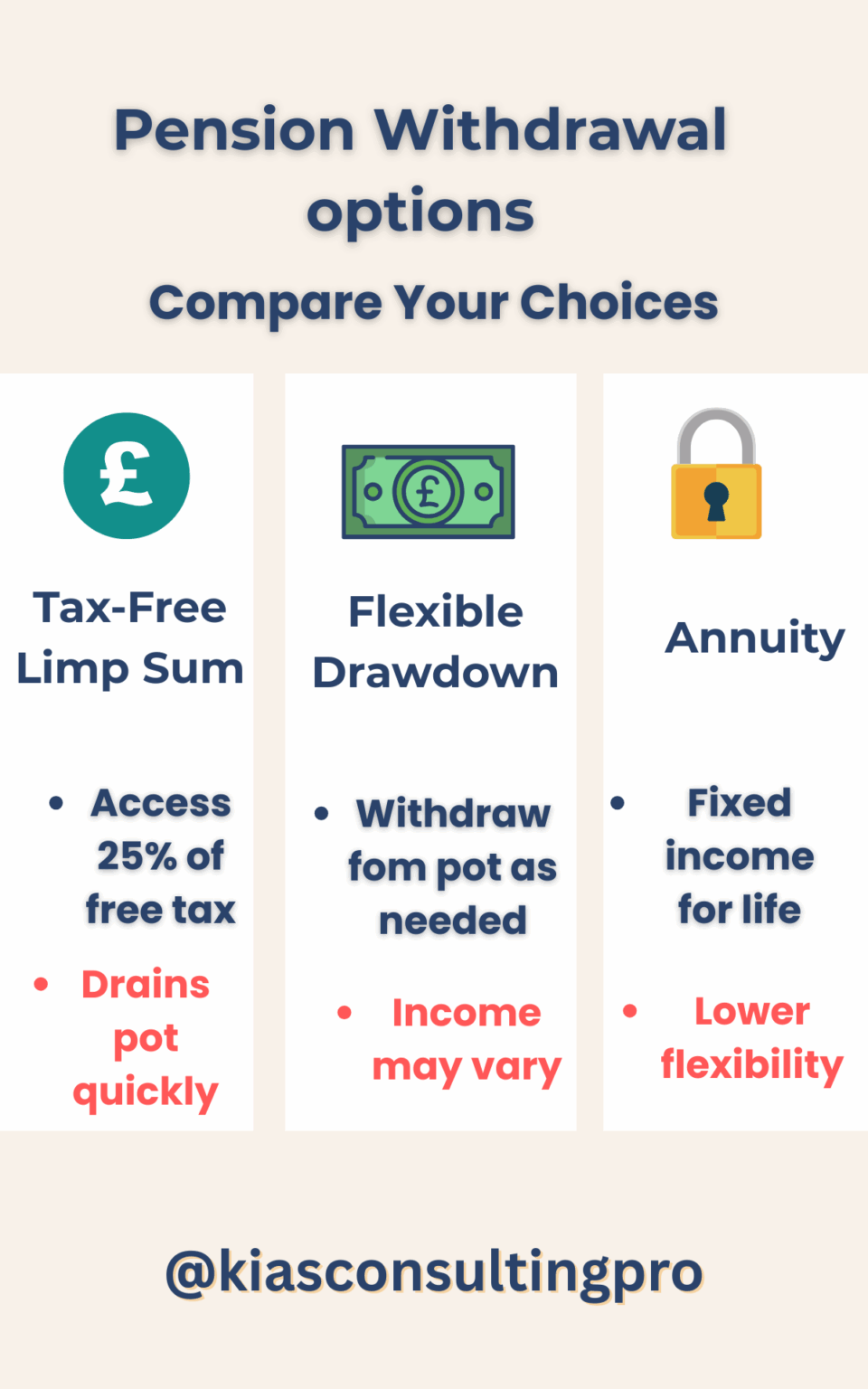

When accessing your pension, you typically have three main choices:

- Tax-Free Lump Sum: You can withdraw up to 25% of your pension pot tax-free starting at age 55 (this will increase to 57 in 2028). You are not required to withdraw the entire amount simultaneously; instead, you can take smaller, phased withdrawals over time, allowing you to manage your tax liabilities more effectively.

- Flexible Drawdown: This option puts you in the driver’s seat, allowing you to withdraw money as and when needed while the rest of your pension pot stays invested. With flexible drawdown, you have complete control over how much you take out and when. Remember, if you exceed your tax-free lump sum, you’ll need to pay income tax on the excess amount.

- Annuities: An annuity is a financial product that offers a safety net. You use your pension pot to purchase a guaranteed income for life, providing you with a secure financial future. While this option may be less flexible than others, it offers peace of mind and financial security.

✅ Explore how pension withdrawals work.

💡 Need help deciding? Download our free Pension vs ISA checklist to help compare your options.

Tax on Pension Withdrawals in the UK

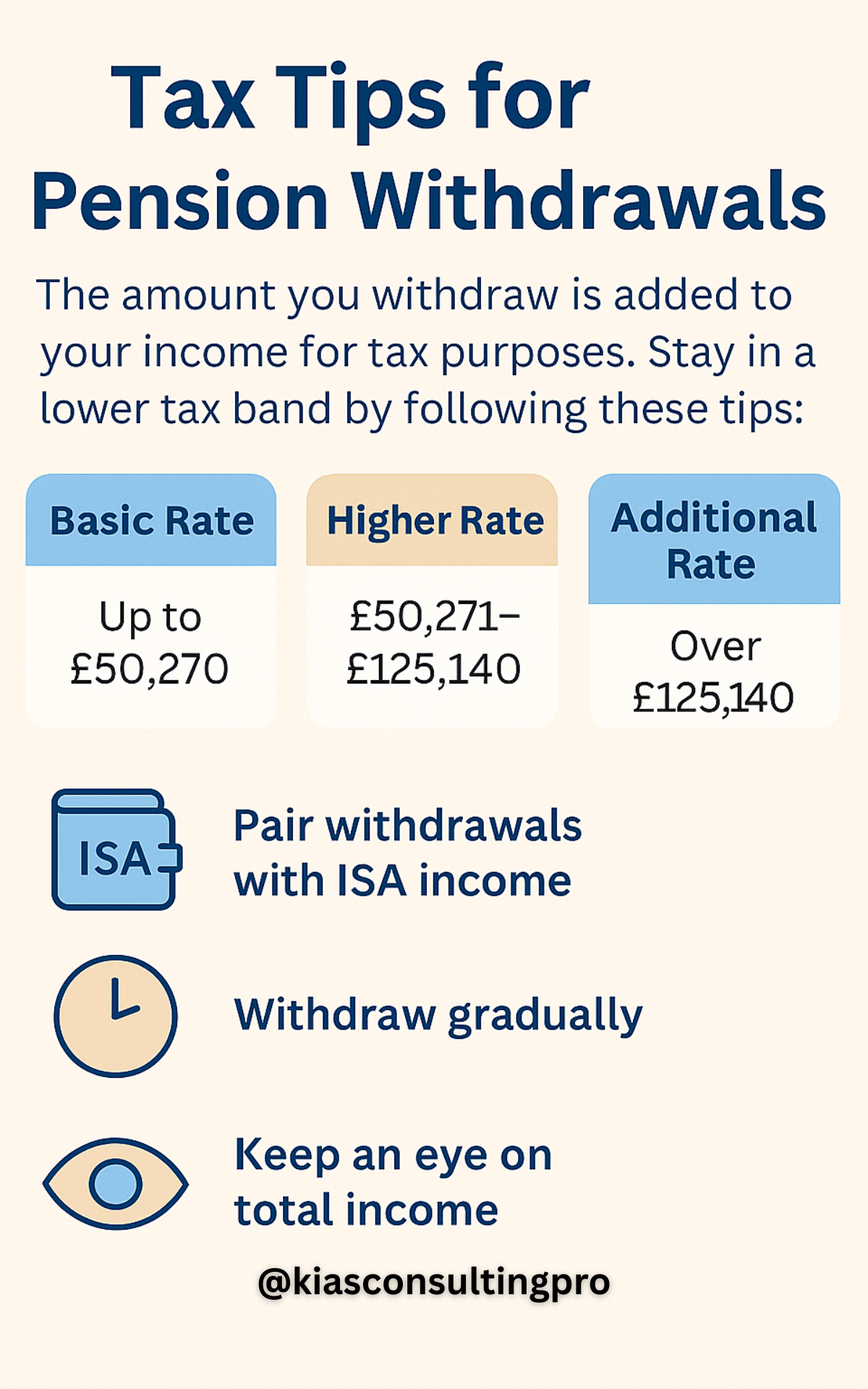

When you withdraw from your pension, the first 25% is tax-free. The remaining amount will be taxed as income at your normal income tax rate:

- Basic Rate (20%): £12,571 to £50,270

- Higher Rate (40%): £50,271 to £125,140

- Additional Rate (45%): Over £125,140

Effective tax planning is essential to minimise how much tax you pay. To do this, consider the following strategies:

- Withdraw only what you need each year to remain within the lower tax bands.

- Combine your pension withdrawals in the UK with income from tax-free ISAs.

Flexible Drawdown vs. Annuities: Which is Better?

- Flexible Drawdown: This option is excellent for individuals who seek control and flexibility over their finances. However, it requires cautious and careful planning to ensure you do not run out of money.

- Annuities: This choice is ideal for those who prefer security and a guaranteed income, though it offers limited flexibility once established.

When deciding, it’s essential to consider your unique circumstances and retirement goals.

Pension Withdrawals UK: Mistakes That Cost You

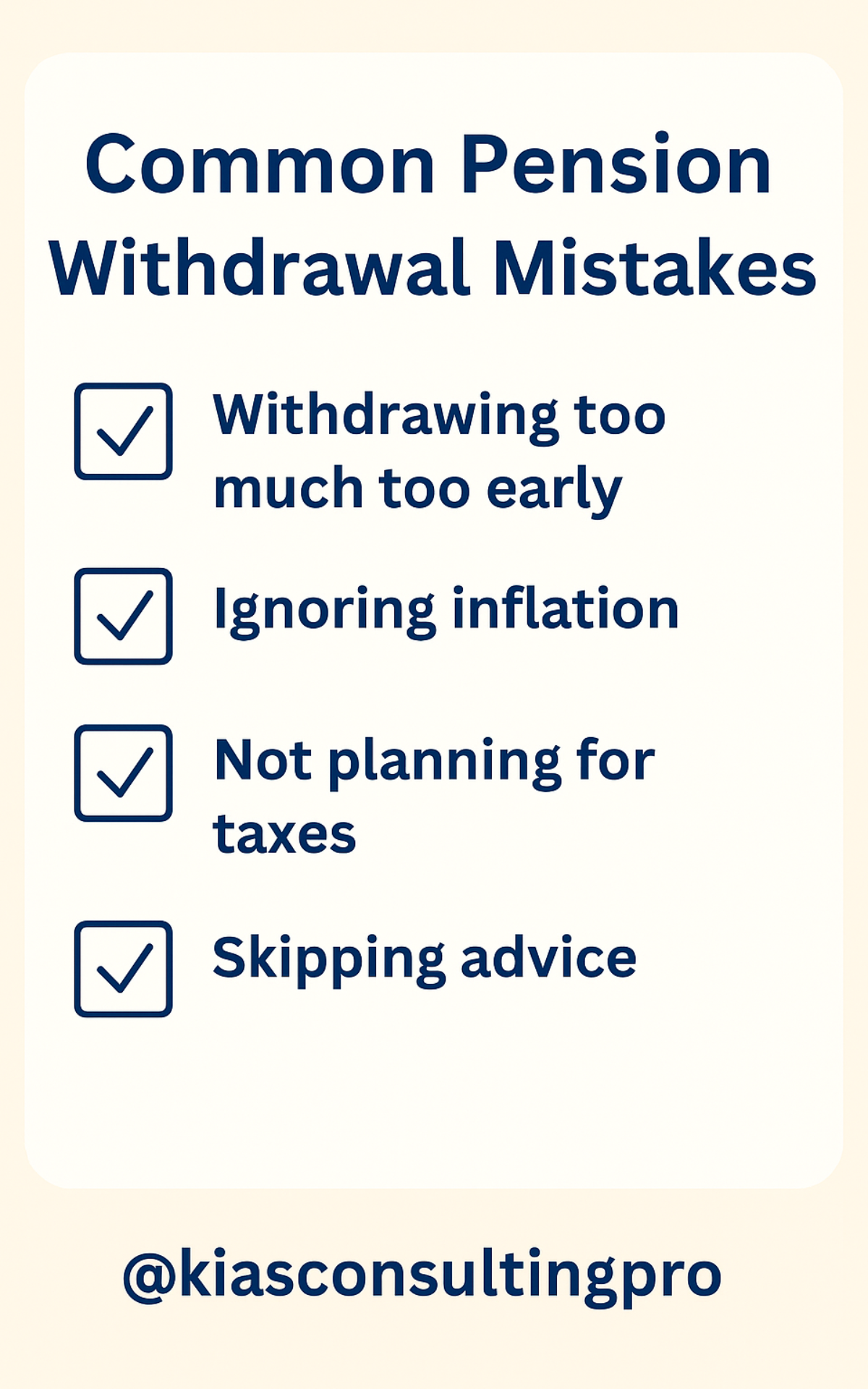

Common pension withdrawal mistakes to avoid include withdrawing too much too soon, which can lead to higher taxes and depleting savings. It’s also crucial to consider inflation, as money withdrawn early misses out on potential growth. Lastly, always consult with a financial advisor or pension specialist before making any decisions.

Real-Life Example: David’s Pension Withdrawal Strategy

David, at 58, has a pension pot of £300,000. He decides to withdraw 25% of it tax-free, a substantial £75,000. His flexible drawdown approach allows him to manage his ongoing income while ensuring he stays within the basic-rate tax band, which is a financially savvy move. To further optimise his tax situation, he supplements his income with savings from his ISA. This tax-efficient strategy helps David maximise the longevity of his pension and minimise his tax liabilities, showcasing his financial insight.

Pensions and Divorce: A Quick Overview

Understanding how pensions are divided in the UK is crucial, as divorce can significantly impact your retirement. Pensions are considered shared assets and may be divided through various methods, including pension sharing, earmarking, or offsetting.

👉 For a comprehensive understanding, don’t miss our bonus guide on how pensions are handled during divorce. It’s a valuable resource for anyone navigating this complex process.

👉 For more detailed information, we recommend checking out the MoneyHelper pension and divorce guide. It’s a reliable source that can provide you with the information you need.

🧠 FAQs: Accessing Your Pension – Withdrawals & Tax Tips

How much will I lose if I take my pension at 55?

You won't lose money directly, but early access means your pension has less time to grow. Withdrawals beyond the 25% tax-free lump sum will also incur income tax.

How to avoid paying tax on pension drawdown?

Stay within your tax-free allowance, withdraw gradually, combine pension income with ISA withdrawals, or consult a financial advisor for tailored tax planning.

Can you take money out of your pension at any time?

From age 55 (57 from 2028), you can access your pension funds flexibly. However, careful planning is advised to manage taxes and pension longevity.

Have You Taken Steps Towards a Secure Retirement?

Congratulations on completing our 7-part UK pension series!

✅ Have you downloaded your Pension By Age Guide

✅Unsure whether you need a pension or an ISA? Grab the Pension vs ISA Comparison Checklist.

✅ Need help taking action? Book your free 1-on-1 session here.

💬 We’d love to hear from you! What actions have you taken so far from the pension series?

Thank you for reading, and here’s to confidently securing your future! 🙌

📩 Join our newsletter for tips, updates, and new posts.

Lifetime ISA Contribution Limits and Bonus Explained (2026 Guide)

Understanding Lifetime ISA contribution limits is crucial for maximising your savings in 2026. The annual limit of £4,000 determines how much government bonus you’ll receive—making it one of the most important aspects of your LISA strategy.

In this comprehensive guide, we explain everything you need to know about LISA contribution limits, including how the £4,000 annual cap works, how it fits within your overall £20,000 ISA allowance, and what happens if you contribute too much.

We’ll also explore practical strategies like monthly versus lump sum contributions, when to contribute for maximum growth, and how to coordinate your LISA with other ISAs. Plus, learn about the 2026 Budget update confirming limits remain frozen until 2031.

Whether you’re saving for your first home or planning for retirement, this guide will help you make the most of your Lifetime ISA contribution allowance and maximise your government bonus.

Will the Lifetime ISA Be Scrapped? Everything We Know About the 2028 Changes

Is the Lifetime ISA being scrapped? Learn what the proposed 2028 changes mean, what stays the same, and how to protect your bonus, retirement options, and home-buying plans.

Hargreaves Lansdown Fee Changes March 2026: What You Really Need to Know

A 515-character summary explaining the key changes (0.45% → 0.35% platform fees, new £1.95 fund charge) and positioning the article as a guide to help readers calculate their impact and decide whether to stay or switch.

Capital Gains Tax on Property in the UK (2025/26)

Capital gains tax on property in the UK can apply when selling a buy-to-let, second home, or inherited property. This 2025/26 guide explains the rules, Private Residence Relief, allowable costs, and the 60-day reporting deadline.

How to Reduce Capital Gains Tax Legally in the UK (2025/26): 10 Strategies That Can Help

Learn how to reduce Capital Gains Tax legally in the UK for 2025/26. 10 practical CGT strategies, clear examples, and a free CGT calculator.

Capital Gains Tax UK: How Much Will You Pay When You Sell an Asset?

Capital Gains Tax can apply when you sell property, shares, or crypto in the UK. This guide explains how CGT works and helps you estimate what you might owe before you sell.