Introduction

Table of Contents

Toggle 📈 Investing Notice: This content is for informational purposes only and not investment advice. Investments can go up and down in value. Always do your own research and seek advice from a regulated professional. See full disclaimer.

Ever wondered how ISAs can grow your wealth tax-free while helping you keep more of what you earn? In the UK, ISAs (Individual Savings Accounts) offer one of the simplest ways to save and invest without paying tax on your interest, dividends, or capital gains.

According to Gov.uk’s ISA guide, every adult gets an annual allowance to invest up to £20,000 tax-free, a powerful tool for long-term wealth building.

As a financial coach, I’ve seen how many people overlook this simple but powerful tool. Whether you’re a beginner saver or an experienced investor, an ISA (Individual Savings Account) gives you the chance to let your money work for you, tax-free.

Imagine earning interest, dividends, or growth on your investments without the taxman taking a slice.

That’s the quiet power of an ISA, and why every smart investor in the UK should have one as part of their financial plan.

In this guide, we’ll unpack how ISAs work, the types available, and how you can use them to build lasting wealth. By the end, you’ll understand how to make your money grow while keeping more of what you earn.

What Is an ISA?

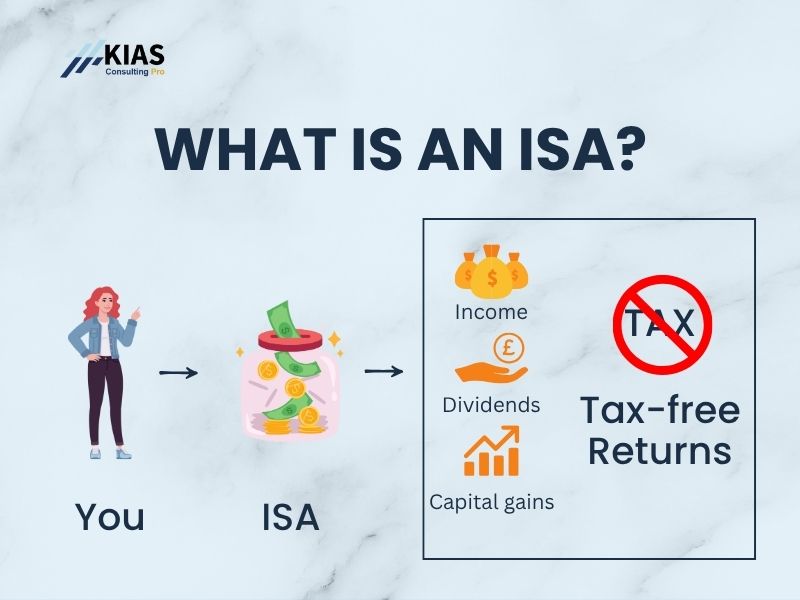

An ISA, or Individual Savings Account, is a financial product available to UK residents that offers a tax-free way to save or invest money. Unlike standard savings accounts or investments, ISAs protect your returns from three types of taxes:

- Income Tax: No taxes on the interest earned from your savings.

- Capital Gains Tax: Profits from investments in Stocks & Shares ISAs are tax-free.

- Dividend Tax: You keep 100% of your dividends within an ISA.

Each tax year, you can save or invest up to £20,000 in ISAs (2024/25 limit), making it a powerful tool for both short-term and long-term financial goals.

Types of ISAs: Choose What Works for You

The beauty of ISAs lies in their flexibility. There’s an option for nearly every financial need:

- Cash ISA: Ideal for those who prefer low-risk savings with guaranteed growth through tax-free interest.

- Stocks & Shares ISA: Perfect for investors seeking higher returns through stocks, bonds, and other assets. To understand the Stocks & Shares ISAs, check out MoneyHelper’s guide to Stocks and Shars ISAs

- Lifetime ISA (LISA): Designed for first-time homebuyers or retirement savings, with a 25% government bonus on contributions.

- Innovative Finance ISA: For those exploring peer-to-peer lending and other alternative investments.

Whether you’re saving for a rainy day, investing for retirement, or aiming to buy your first home, ISAs offer a tailored solution.

Emergency funds & ISAs: You can hold your emergency fund in an easy-access Cash ISA so the interest is tax-free and your money stays available.

Pro Tip:

Avoid locking this pot in fixed-term Cash ISAs where early withdrawals can lose interest. A Lifetime ISA isn’t suitable for emergencies (25% withdrawal charge unless buying your first home or after age 60). A Stocks & Shares ISA also isn’t ideal for emergencies because market values can fall just when you need the money.

Key Benefits of ISAs

So, why should you prioritise ISAs in your financial planning? Here are the standout benefits:

- 💸 Tax-Free Growth: Every pound you earn stays in your account.

- 📈 Flexible Options: Choose savings, investments, or both, depending on your goals.

- 💷 Generous Allowance: Save or invest up to £20,000 per year.

- 🎁 Government Boost: Enjoy bonuses through Lifetime ISAs.

- 🔒 Secure Savings: Cash ISAs are protected by the FSCS up to £85,000.

Who Can Open an ISA?

To open an ISA, you must be:

- A UK resident.

- Over 16 years old for a Cash ISA or 18 for other types.

Parents can also open Junior ISAs for children under 18, making ISAs a great way to teach kids about money and secure their future.

Why It’s Time to Start Now

The earlier you take advantage of ISAs, the more you can benefit from tax-free growth and compound interest. Whether you’re a cautious saver or a savvy investor, ISAs provide an efficient way to build wealth without worrying about tax implications.

💡 Try it yourself: Wondering how your ISA savings could grow over time? Use the interactive calculator below to estimate how your money can compound tax-free. Adjust your monthly contributions, interest rate, and years to see the difference consistency makes.

💡 Compound Interest Calculator

Ending balance: —

Total contributions: —

Total interest: —

Real (inflation-adjusted) balance: —

📊 Yearly summary

| Year | Start Balance | Contributions | Interest | End Balance |

|---|

🚀 Tip: The earlier you start, the more time your money has to grow through compound interest. Even small amounts invested regularly can make a big difference over time.

💡 Pro Tip:

Don’t wait until the end of the tax year to max out your ISA allowance. Contribute regularly to take advantage of market opportunities and smooth out investment risks over time.

Understanding how ISAs can grow your wealth tax-free isn’t just about avoiding tax, it’s about creating freedom. The earlier you start, the more time your savings have to compound and work for you. Even small, consistent contributions can lead to significant long-term growth.

Whether you use a Cash ISA for short-term security or a Stocks and Shares ISA for long-term investing, what matters most is getting started.

💡 The best time to start investing was yesterday. The second-best time is today.

Want to explore how this fits into your financial plan? Read my Lifetime ISA comparison guide or message me to learn more.

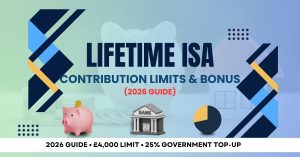

Lifetime ISA Contribution Limits and Bonus Explained (2026 Guide)

Understanding Lifetime ISA contribution limits is crucial for maximising your savings in 2026. The annual limit of £4,000 determines how much government bonus you’ll receive—making it one of the most important aspects of your LISA strategy.

In this comprehensive guide, we explain everything you need to know about LISA contribution limits, including how the £4,000 annual cap works, how it fits within your overall £20,000 ISA allowance, and what happens if you contribute too much.

We’ll also explore practical strategies like monthly versus lump sum contributions, when to contribute for maximum growth, and how to coordinate your LISA with other ISAs. Plus, learn about the 2026 Budget update confirming limits remain frozen until 2031.

Whether you’re saving for your first home or planning for retirement, this guide will help you make the most of your Lifetime ISA contribution allowance and maximise your government bonus.

Will the Lifetime ISA Be Scrapped? Everything We Know About the 2028 Changes

Is the Lifetime ISA being scrapped? Learn what the proposed 2028 changes mean, what stays the same, and how to protect your bonus, retirement options, and home-buying plans.

Hargreaves Lansdown Fee Changes March 2026: What You Really Need to Know

A 515-character summary explaining the key changes (0.45% → 0.35% platform fees, new £1.95 fund charge) and positioning the article as a guide to help readers calculate their impact and decide whether to stay or switch.

Capital Gains Tax on Property in the UK (2025/26)

Capital gains tax on property in the UK can apply when selling a buy-to-let, second home, or inherited property. This 2025/26 guide explains the rules, Private Residence Relief, allowable costs, and the 60-day reporting deadline.

How to Reduce Capital Gains Tax Legally in the UK (2025/26): 10 Strategies That Can Help

Learn how to reduce Capital Gains Tax legally in the UK for 2025/26. 10 practical CGT strategies, clear examples, and a free CGT calculator.

Capital Gains Tax UK: How Much Will You Pay When You Sell an Asset?

Capital Gains Tax can apply when you sell property, shares, or crypto in the UK. This guide explains how CGT works and helps you estimate what you might owe before you sell.