Table of Contents

ToggleIf you’ve changed jobs over the past few years, chances are you’ve left a workplace pension or two behind. The time to act is now. Also, you may want to read this guide on what happens to your pension when you change jobs.

And while those pensions are quietly growing in the background, here’s the harsh truth:

Many are stuck in default funds, which are pre-selected investment options chosen by your pension provider, that aren’t performing as well as they could.

This week alone, I’ve helped clients review their current pensions — and in some cases, transfer their old ones — and the results were eye-opening.

That’s why I’m now offering a Free 1:1 Pension Review. Don’t let your hard-earned money sit in a pension that’s not working for you. Sign up for the review today and take control of your financial future.

📚 Related Reading:

Types of Pensions in the UK Explained

Why Default Pension Funds Might Be Letting You Down

Most workplace pensions automatically invest your money in a “default” fund, designed to be one-size-fits-all.

But your goals, age, risk level, and financial situation aren’t the same as everyone else’s.

Here’s why that matters:

📉 Default funds often carry low to moderate risk, which may not deliver long-term growth.

🕰️ They’re not tailored to your retirement timeline or personal circumstances.

📦 You may have several old pensions scattered across different providers, making it difficult to track how each is performing.

Not sure what type of pension you have? Here’s a helpful overview of pension types in the UK.

Real-Life Example

One of my clients recently changed jobs, and we reviewed his old workplace pension before transferring it into a Self-Invested Personal Pension (SIPP). We discovered that his pension was invested in the provider’s default fund, a diversified mix comprising approximately 70% equities, 10% bonds, 5% gold, and other assets.

While this was a broadly diversified portfolio, it wasn’t necessarily optimised for his situation. He’s still many years away from retirement and currently in the wealth accumulation phase, which means he is in a stage where he can afford to take on more risk for potentially greater reward, as he has time on his side.

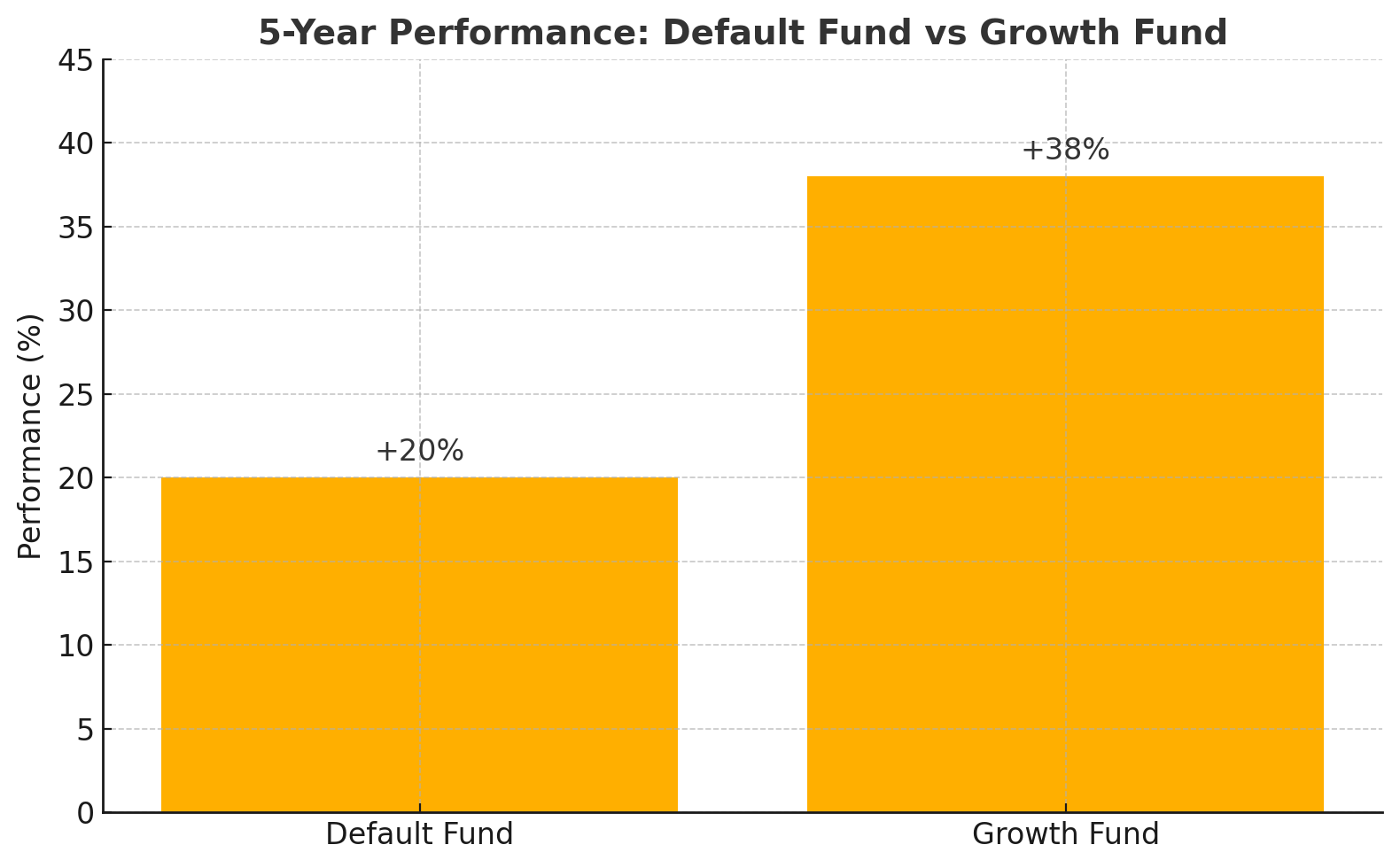

When we compared the historical performance of that default fund to a more growth-focused alternative, the difference was striking:

The default fund had returned around 20% over the past 5 years.

The alternative growth fund delivered close to 38% in the same period

Of course, past performance doesn’t guarantee future results, and market volatility is always a factor. Still, this example shows how default options aren’t always the most suitable, especially for those with long-term investment horizons.

By tailoring his pension strategy to match his time frame and goals, he’s now in a better position to grow his retirement savings more effectively. This strategic shift has put him in a more secure position for his retirement.

What You’ll Get in the Free Pension Review

This is not a sales call. It’s a focused, value-driven 1:1 session designed to help you:

- Find old workplace pensions you may have forgotten about

- Check if your pension is in the right investment fund

- Understand your options (without overwhelming jargon)

- Take steps to make your money work harder

If you’d like to learn more about how pensions work in general, visit MoneyHelper’s guide to pensions.

Who Is This For?

This free session is ideal if:

- You’ve changed jobs at least once in the last 5–10 years.

- You’re unsure where your pensions are or how they’re performing.

- You want to take control of your retirement planning, but don’t know where to start.

📈 Investing Notice: This content is for informational purposes only and not investment advice. Investments can go up and down in value. Always do your own research and seek advice from a regulated professional. See full disclaimer.

Lifetime ISA Contribution Limits and Bonus Explained (2026 Guide)

Understanding Lifetime ISA contribution limits is crucial for maximising your savings in 2026. The annual limit of £4,000 determines how much government bonus you’ll receive—making it one of the most important aspects of your LISA strategy.

In this comprehensive guide, we explain everything you need to know about LISA contribution limits, including how the £4,000 annual cap works, how it fits within your overall £20,000 ISA allowance, and what happens if you contribute too much.

We’ll also explore practical strategies like monthly versus lump sum contributions, when to contribute for maximum growth, and how to coordinate your LISA with other ISAs. Plus, learn about the 2026 Budget update confirming limits remain frozen until 2031.

Whether you’re saving for your first home or planning for retirement, this guide will help you make the most of your Lifetime ISA contribution allowance and maximise your government bonus.

Will the Lifetime ISA Be Scrapped? Everything We Know About the 2028 Changes

Is the Lifetime ISA being scrapped? Learn what the proposed 2028 changes mean, what stays the same, and how to protect your bonus, retirement options, and home-buying plans.

Hargreaves Lansdown Fee Changes March 2026: What You Really Need to Know

A 515-character summary explaining the key changes (0.45% → 0.35% platform fees, new £1.95 fund charge) and positioning the article as a guide to help readers calculate their impact and decide whether to stay or switch.

Final Thought

You don’t need to be an expert to build a strong financial future, you just need to ask the right questions and take small, consistent steps.

And reviewing your pension is one of the most powerful (and often ignored) steps you can take.

So ask yourself:

Is your pension really in the right place?

If you’re not 100% sure, let’s talk.

Spaces are limited each month so I can give each review the attention it deserves.

📥 PS:

Want free financial tips like this each month? Join my email list and get resources to help you plan, save, and invest wisely.