Table of Contents

Toggle 📈 Investing Notice: This content is for informational purposes only and not investment advice. Investments can go up and down in value. Always do your own research and seek advice from a regulated professional. See full disclaimer.

Buying your first home is an exciting milestone, but it can also be daunting, especially when figuring out finances. Thankfully, if you’ve opened a Lifetime ISA (LISA), a government-backed savings account that allows you to save for your first home or retirement, you’re already a step ahead. Let’s explain how you can utilise your LISA savings effectively, whether you plan to buy a house soon or save long-term for retirement.

Watch this short video to understand how you can use your Lifetime ISA to boost your savings for your first home or retirement.

Who Can Use a Lifetime ISA for First-Time Buyers?

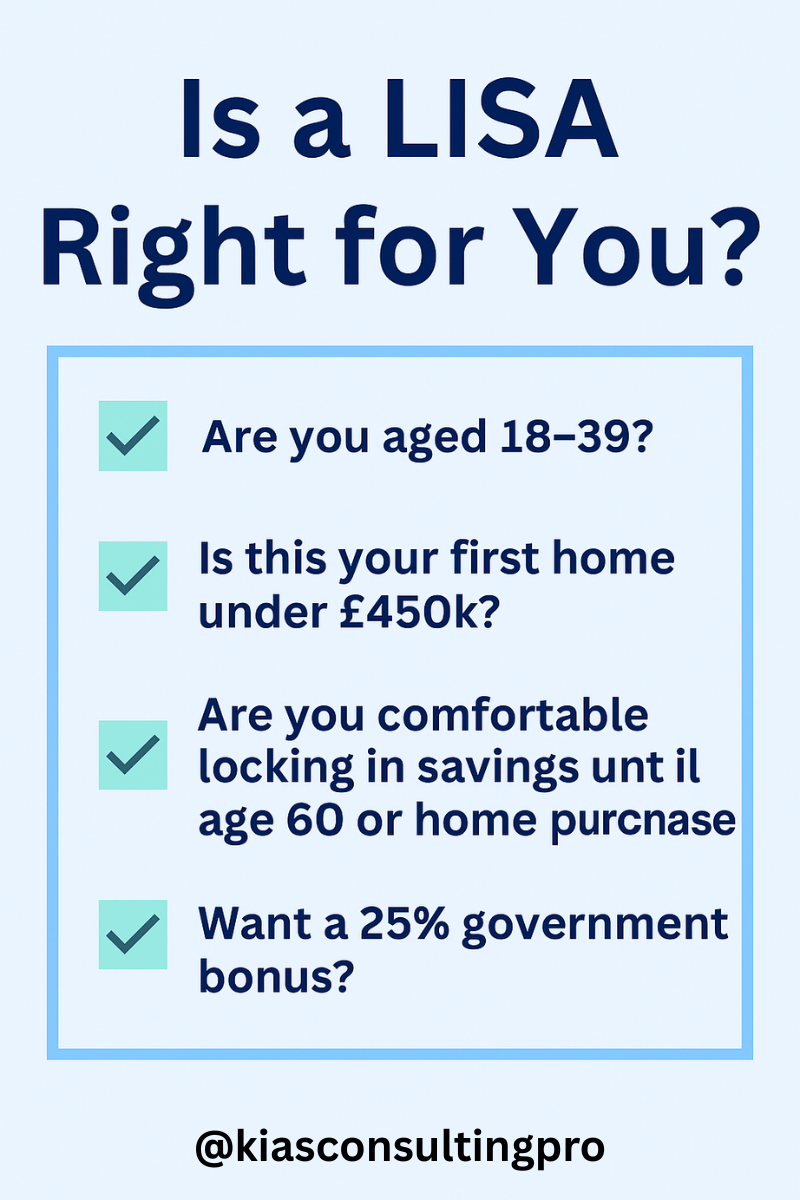

To open and use a Lifetime ISA for first-time buyers, you must meet a few eligibility rules:

✅ Be aged 18 to 39 at the time of opening the account

✅ Never have owned a property before in the UK or abroad

✅ Be purchasing a home that costs £450,000 or less

✅ Be using a mortgage and a qualified solicitor or conveyancer

✅ Have the LISA open for at least 12 months before using it

✅ Be comfortable locking in your savings until age 60, if not using the funds for a home purchase

📌 If all of these apply, a Lifetime ISA could be one of the most effective ways to boost your first home deposit with a 25% government bonus, up to £1,000 per year.

🖼️ See the visual checklist below to double-check if you qualify:

Step-by-Step Guide to Using Your LISA for a Home Purchase in the UK

Step 1: Open Your LISA Account

To qualify, you must open your LISA between the ages of 18 and 39. Even if you’re not ready to contribute immediately, opening one as early as possible is wise to secure eligibility.

Step 2: Meet the Eligibility Requirements

To use your LISA for a home purchase, you must:

Be a first-time buyer (never owned a property anywhere globally).

Buy a property valued at £450,000 or less.

Have your LISA open for at least 12 months before withdrawing funds.

Step 3: Understanding the 12-Month Rule

You can’t use your LISA funds for a home purchase if you’ve had your account for less than 12 months. Planning ahead is crucial; open your account early and contribute consistently if you can.

Step 4: The Withdrawal Process

Your solicitor or conveyancer will handle the LISA withdrawal directly from your provider. You never receive the money personally—it goes straight toward your property purchase at the completion stage.

You can read more about LISAs on GOV.UK.

Key Rules & Conditions

Property Value Limit: Your chosen property must not exceed the £450,000 limit. This is a key factor that will influence your decision-making process.

Mortgage and Conveyancer Requirements: You must purchase using a mortgage (not cash-only) and have a qualified conveyancer or solicitor handle the transaction. These are not just formalities but crucial steps in the process.

Joint Purchases: If you’re buying jointly, you must both be first-time buyers and meet all LISA eligibility criteria to use your LISA funds.

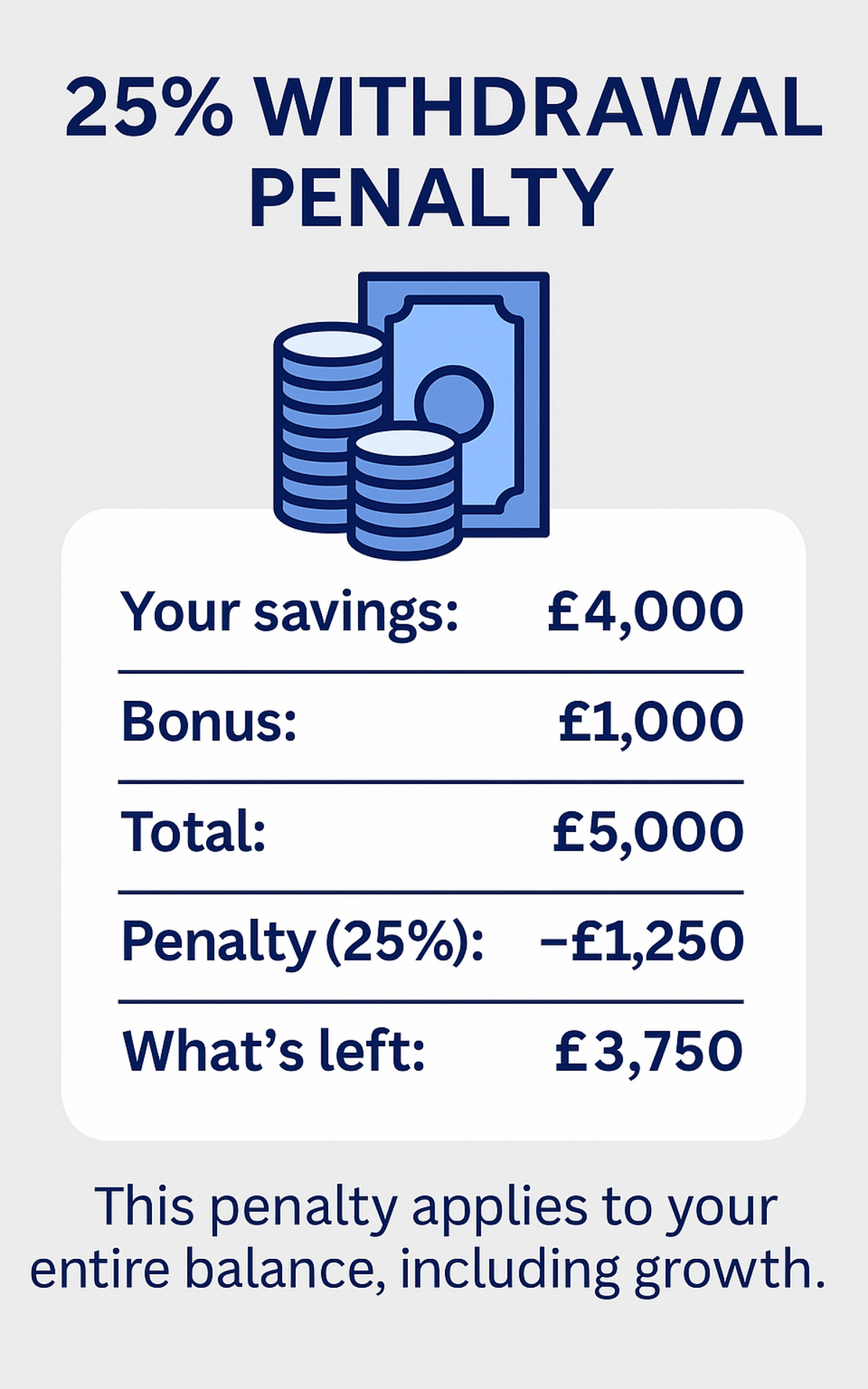

Penalties: It’s important to remember that withdrawing early or for reasons other than home purchase, retirement, or if you become terminally ill with less than 12 months to live, incurs a 25% penalty. This is a serious matter that could cost you your government bonus and potentially part of your savings. The 25% penalty applies to your total balance, including interest and any growth.

Using Your LISA for Retirement, Even If You Don’t buy Your First Home in the UK

Perhaps you’re not planning to purchase your first home soon, or don’t plan to buy a home. Probably because you don’t want to own a home or you already bought your first home in the UK, a LISA remains incredibly beneficial for retirement:

You still gain the substantial 25% government bonus.

Another advantage of a LISA is that all withdrawals after age 60 are entirely tax-free. This means that any money you take out of your LISA after you turn 60, whether it’s your original contributions or the government bonus, is yours to keep, without any tax deductions.

With its tax-free withdrawals after age 60, a LISA offers a longer-term financial strategy that’s more attractive than traditional pensions, which can be taxable upon withdrawal. Regardless of immediate funding, opening a LISA before age 40 is a forward-thinking choice for your financial future.

When I opened my LISA, I knew I wouldn’t use it for my first home. But the 25% annual bonus (up to £1,000 yearly) was too valuable to pass up, and this kind of flexibility can empower you in your financial planning!

You can learn more about why an ISA should be in your financial plan.

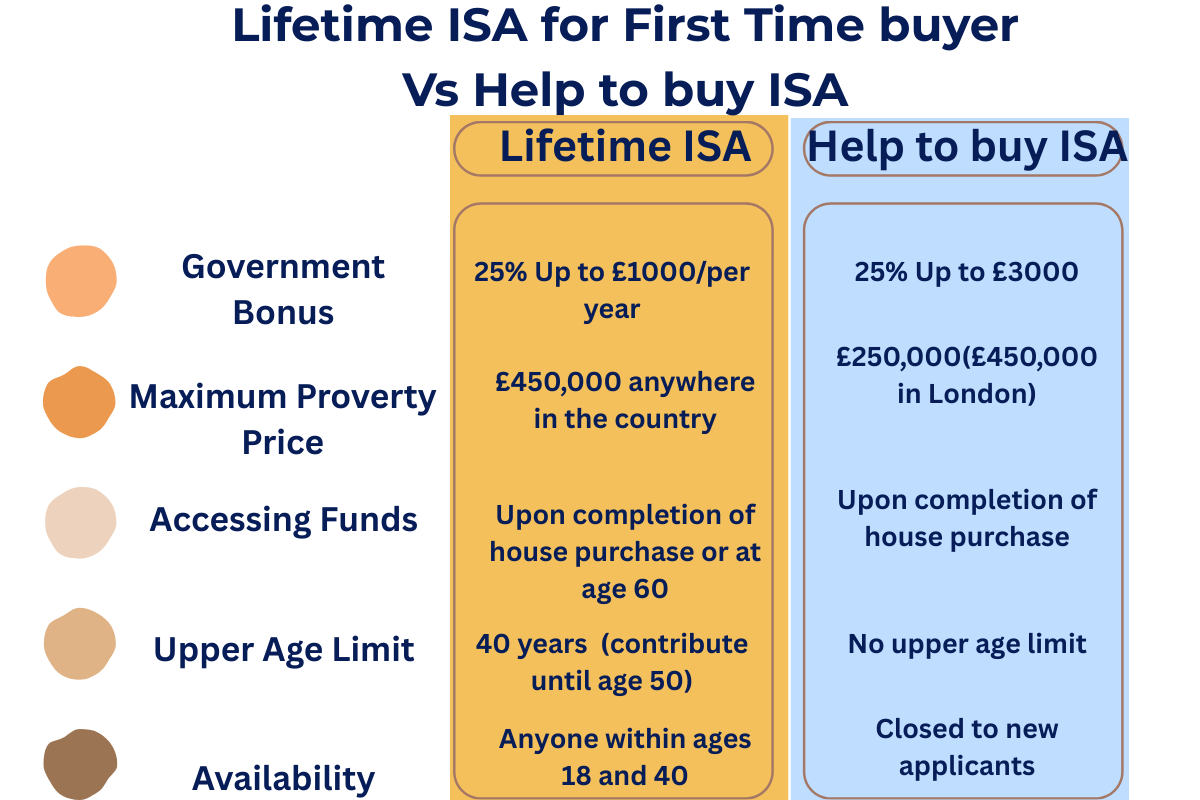

Lifetime ISA vs Help to Buy ISA: Key Differences

| Feature | Lifetime ISA | Help to Buy ISA |

|---|---|---|

| Maximum Bonus | £1,000 per year | £3,000 total |

| Property Limit | £450,000 nationwide | £250,000 (£450,000 in London) |

| Contribution Limit | £4,000 per year | £200 per month (plus initial £1,200) |

| Eligibility | Age 18-39 | No longer available to new holders (Existing holder only) |

| Withdrawal flexibility | Penalties for non-home/retirement withdrawal | No penalties but bonus only available at purchase |

A LISA generally offers greater long-term flexibility and higher bonus potential, especially if you’re planning ahead or considering retirement savings.

You can read more about Help to Buy ISAs on GOV.UK.

Practical Tips for a Smooth LISA Home Purchase in the UK

Timing Matters: Start the withdrawal process well ahead of your home purchase completion.

Conveyancer Coordination: Choose a solicitor familiar with LISAs to ensure smooth processing.

Avoid Mistakes: Always confirm eligibility and property limits clearly upfront.

Frequently Asked Questions (FAQs):

1. What if the property exceeds £450,000?

You won’t be able to use LISA funds without penalty.

2. Can I transfer from Help to Buy ISA to LISA?

Yes, but understand any transferred amount counts toward your annual LISA limit.

3. Can I transfer my Cash LISA to a Stocks & Shares LISA, or vice versa?

Absolutely, provided each person meets eligibility individually.

Ready to Take the Next Step of purchasing your first home in the UK?

Navigating property purchases or retirement planning can feel complex, but you’re not alone. At KIAS Consulting Pro, we’re here to guide you.

Book your free consultation today, remember to subscribe below. By doing so, you’ll receive regular updates on the latest financial trends and tips, helping you stay informed and make better financial decisions

If you’re interested in investing through a Stocks & Shares LISA, check out our guide on How to Invest in Stocks UK. This comprehensive guide covers everything from understanding stock markets to making your first investment.

Lifetime ISA Contribution Limits and Bonus Explained (2026 Guide)

Understanding Lifetime ISA contribution limits is crucial for maximising your savings in 2026. The annual limit of £4,000 determines how much government bonus you’ll receive—making it one of the most important aspects of your LISA strategy.

In this comprehensive guide, we explain everything you need to know about LISA contribution limits, including how the £4,000 annual cap works, how it fits within your overall £20,000 ISA allowance, and what happens if you contribute too much.

We’ll also explore practical strategies like monthly versus lump sum contributions, when to contribute for maximum growth, and how to coordinate your LISA with other ISAs. Plus, learn about the 2026 Budget update confirming limits remain frozen until 2031.

Whether you’re saving for your first home or planning for retirement, this guide will help you make the most of your Lifetime ISA contribution allowance and maximise your government bonus.

Will the Lifetime ISA Be Scrapped? Everything We Know About the 2028 Changes

Is the Lifetime ISA being scrapped? Learn what the proposed 2028 changes mean, what stays the same, and how to protect your bonus, retirement options, and home-buying plans.

Hargreaves Lansdown Fee Changes March 2026: What You Really Need to Know

A 515-character summary explaining the key changes (0.45% → 0.35% platform fees, new £1.95 fund charge) and positioning the article as a guide to help readers calculate their impact and decide whether to stay or switch.

Capital Gains Tax on Property in the UK (2025/26)

Capital gains tax on property in the UK can apply when selling a buy-to-let, second home, or inherited property. This 2025/26 guide explains the rules, Private Residence Relief, allowable costs, and the 60-day reporting deadline.

How to Reduce Capital Gains Tax Legally in the UK (2025/26): 10 Strategies That Can Help

Learn how to reduce Capital Gains Tax legally in the UK for 2025/26. 10 practical CGT strategies, clear examples, and a free CGT calculator.

Capital Gains Tax UK: How Much Will You Pay When You Sell an Asset?

Capital Gains Tax can apply when you sell property, shares, or crypto in the UK. This guide explains how CGT works and helps you estimate what you might owe before you sell.

How to Build Your Credit Score in the UK (2026): Cards, Apps & Smart Money Habits

A practical 2026 guide on how to build your credit score in the UK using credit cards, apps and smart money habits, without damaging your finances.

Investment Fees Explained: The Real Cost of Investing (and How to Pay Less in 2025)

Investment fees can quietly shrink your long-term returns. This simple UK guide explains the main types of fees, how they affect your portfolio, and practical ways to reduce costs in 2025 so more of your money stays invested for your future.