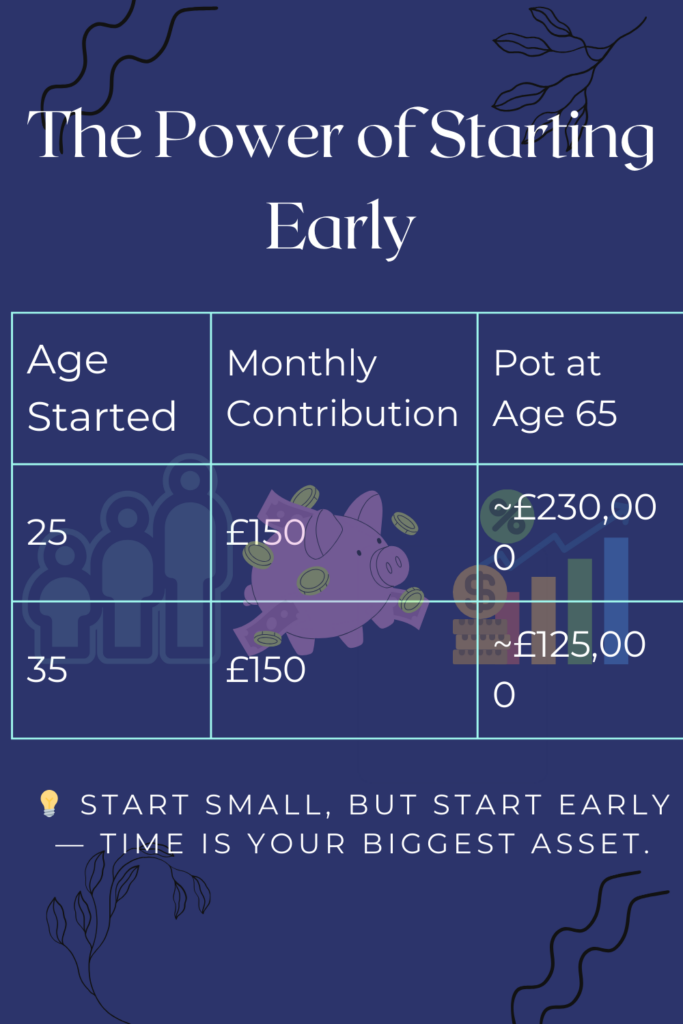

When it comes to saving for the future, many UK savers ask: what’s the difference between a pension and an ISA in the UK and which is best for retirement? Both options come with excellent tax benefits, but they serve different purposes. Pensions offer tax relief and potential for employer contributions, providing a structured approach to saving. ISAs, on the other hand, provide tax-free growth and flexible access, catering to your immediate financial needs. The choice between the two is not just about numbers but your personal goals, income, and how soon you’ll need access to your money.

Table of Contents

ToggleThis guide breaks down the differences between pensions and ISAs, explores the pros and cons of each, and offers examples to help you decide.

🔍 What’s the Difference Between a Pension and an ISA?

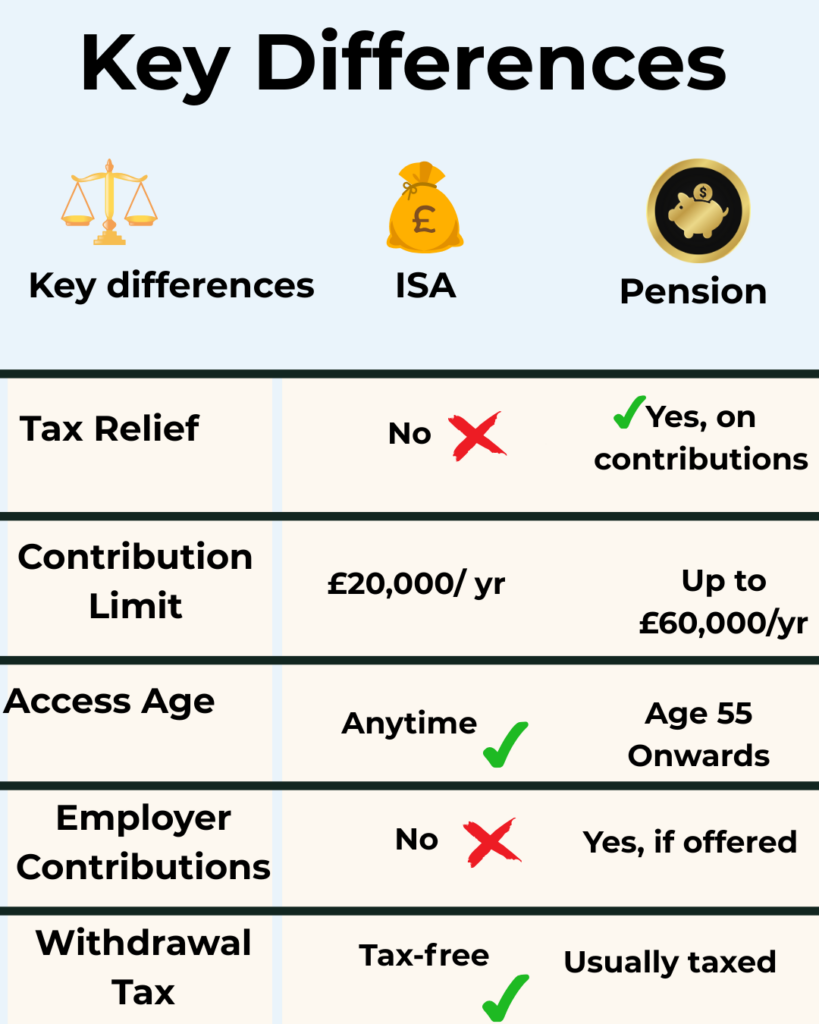

| Feature | Pension | ISA (Stocks & Shares ISA) |

|---|---|---|

| Tax Relief | Contributions receive income tax relief | No upfront tax relief, but growth is tax-free |

| Contribution Limits (2024/25) | £60,000 annually (subject to income) | £20,000 annually |

| Access Age | 55 (rising to 57 from 2028) | Anytime |

| Employer Contributions | Yes (workplace pensions) | No |

| Tax on Withdrawals | 25% tax-free, the remainder taxed as income | No tax on withdrawals |

If you’re deciding between a pension vs ISA UK for retirement planning, it helps to understand how each one impacts your taxes and long-term savings.

💡 Types of ISAs Explained: How They Compare to Pensions in the UK

There are several types of Individual Savings Accounts (ISAs) available in the UK, each designed for different savings goals:

1. Cash ISA

- Like a traditional savings account, a Cash ISA offers a secure and familiar way to save, providing a sense of security about your financial future.

- No tax on interest earned.

- Ideal for low-risk savers

2. Stocks & Shares ISA

- Invests in funds, stocks, and other assets

- With more risk comes the potential for higher returns, making a Stocks & Shares ISA an attractive option for those with long-term financial goals such as buying a house, funding a child's education, or planning a comfortable retirement. It instils a sense of optimism about your financial future.

- Great for long-term goals like retirement

3. Lifetime ISA (LISA)

- A Lifetime ISA (LISA) allows you to save up to £4,000/year with a 25% government contribution bonus, making it an excellent option for those saving for their first home or retirement (from age 60).

- Use for first home purchase or retirement (from age 60)

- Must be between 18–39 to open

4. Innovative Finance ISA

- Peer-to-peer lending platform returns

- Higher risk and less common

5. Junior ISA

- For under 18s

- Managed by a parent or guardian

- Up to £9,000/year (2024/25)

- Related: Are Stocks and Shares ISAs Worth It?

- Read: Why an ISA Should Be in Your Financial Plan.

You can contribute up to £20,000 a year to ISAs in the 2024/25 tax year GOV.UK.

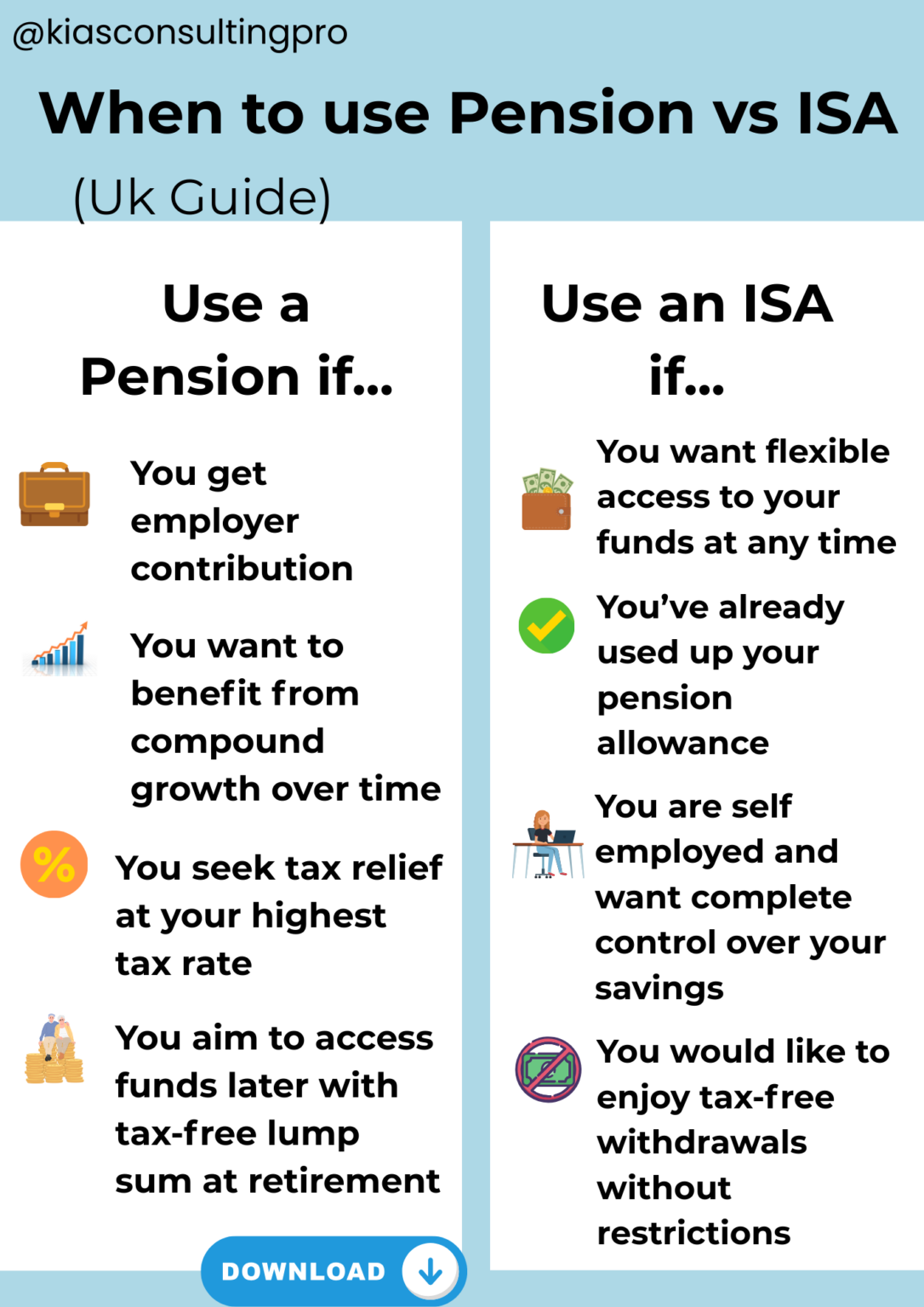

💰 When a Pension Might Be Better

- You want to maximise tax relief, especially if you're a higher-rate taxpayer. HMRC offers tax relief on pension contributions, meaning some of your income that would’ve gone to tax goes into your pension instead. This is a significant advantage as it effectively increases the amount you can save for your retirement.

- Your employer offers contributions (free money!)

- Your employer offers contributions (free money!)

Example: Emma earns £45,000 and contributes £400/month to her pension. She gets tax relief + a 5% employer match; that’s an instant boost.

📈 When to Choose an ISA Over a Pension

- You want the flexibility to withdraw anytime, allowing you to make financial decisions that suit your needs.

- You already max out your pension or want to save beyond the pension age.

- You prefer tax-free income in retirement.

Example: Sam is self-employed and contributes £300/month to a Stocks & Shares ISA. He enjoys growth with no withdrawal restrictions.

- Related: Choosing an ISA Platform

- Vanguard investor? Read: Vanguard’s 2025 Fee Update

👥 Employed vs Self-Employed: What’s Best?

Many self-employed savers ask whether they’re better off with a pension or ISA. Our pension vs ISA UK comparison shows that using both often gives the best flexibility and tax relief.

Employed

- Use your workplace pension to get employer contributions.

- Add an ISA for more flexible savings

Self-Employed

- Consider a SIPP (Self-Invested Personal Pension) for tax relief.

- Use an ISA to save for earlier goals or added freedom

- Up to £9,000/year (2024/25)

- Related: Earn an Extra £1000 a Month – Side Hustles

- Read: 10 Smart Debt Management Strategies

🧮 Can You Combine a Pension and ISA in the UK?

According to MoneyHelper, pensions are designed to give you a reliable income later in life, with valuable tax benefits, especially when combined with workplace contributions.

Many people use both pensions and ISAs:

- Pensions for long-term retirement income

- ISAs for flexibility, early retirement, or wealth-building

This way, you get tax advantages on pension contributions now and easy access to your ISA funds when needed.

- Tip: Track your income and savings using our Pension Checklist by Age (PDF)

👪 Pension vs ISA UK; What Happens When You Die?

Inheritance rules vary depending on the account and type of pension.

ISAs

- Passed on tax-free to your spouse or civil partner (they can inherit the full amount into a "continuing ISA allowance")

- For other beneficiaries, ISA value forms part of your estate (may be subject to Inheritance Tax)

Defined Contribution (DC) Pensions

This is also known as money purchase pensions, which are based on how much money has been paid into the pension pot. They can be passed on tax-free if you die before age 75 (this rule ends in April 2025). which is a government incentive that reduces the amount of tax you pay on your pension contributions.

- Can be passed on tax-free if you die before age 75 (this rule ends April 2025)

- From April 2025, death benefits from pensions will be taxed at the beneficiary’s income tax rate, regardless of age. If you die before age 75, your beneficiaries can receive the pension pot tax-free. However, if you die after age 75, the pension pot will be subject to income tax at the beneficiary’s rate.

- Beneficiaries can choose a lump sum, income, or transfer to their pension.

Defined Benefit (DB) Pensions

- May provide a reduced income for your spouse or dependents

- Usually, it cannot be inherited as a lump sum

Annuities

Inheritance depends on the annuity type:

- Single-life: ends at your death

- Joint-life or Guaranteed-term: may continue to pay your spouse/dependents

- Related: Plan Your Retirement: A Beginner’s Guide

✅ Summary: When to Use a Pension vs an ISA

| Scenario | Best Option |

| Employer offers a match | Pension |

| You need flexibility | ISA |

| You’re self-employed | SIPP + ISA |

| You want tax-free income | ISA |

| Long-term retirement savings | Pension |

📥 Download Our Free Comparison Checklist

Deciding between a pension or an ISA?

Use our simple one-page checklist to help you decide which option fits your savings goals, lifestyle, and tax strategy.

📘 Related Resources

🔎 FAQs on Pensions vs ISAs

Can I use both a pension and an ISA?

Yes, and many people should. Pensions offer long-term tax relief, while ISAs provide flexibility and tax-free access.

What’s the annual limit for each?

In 2024/25; Pension: Up to £60,000 (or 100% of your earnings, whichever is lower) ISA: Up to £20,000 (across all ISAs apart from Juniour ISA, which has an alloawance of £9,000.00)

Is an ISA riskier than a pension?

It depends on how you invest the funds. Both can hold stocks and funds, and both carry investment risk, but pensions usually is invested for a more extended timeframe, which gives it more time to ride the market volatility

What happens to my ISA and pension when I die?

Both can be passed to beneficiaries, but tax treatment varies. ISAs are generally tax-free; pensions may be taxed depending on age at death and beneficiary rules.