Changing jobs in the UK doesn’t mean you lose your pension, but it’s essential to understand what happens to your pension when you change jobs in the UK, how to protect your savings, and what steps to take to stay on track for retirement.

Table of Contents

Toggle💬 This is Part 5 of our UK Pension Series; your 7-part guide to understanding how pensions work, building long-term wealth, and planning for a secure retirement.

If you’re just joining us, check out the complete series here: UK Pension Series Hub

🧳Pension When You Leave a Job: What Happens in the UK?

When you leave a job, your workplace pension stays right where it is, in your name. You don’t lose the money, but you won’t receive new contributions unless you consolidate or move it. This means that the growth of your pension pot might slow down, as new contributions often contribute to its growth.

You keep the pension pot and its investment growth. The growth of your pension pot depends on the performance of the investments it’s tied to, and it’s essential to keep this in mind when considering your pension options.

Your former employer stops contributing.

You can choose to leave it where it is, transfer it to a new pension provider, or combine it with your new workplace pension

✅ Tip: Always check for any fees or charges before transferring a pension.

🔁 Can You Transfer a DB or DC Pension?

If you’re unsure what happens to your pension when you change jobs in the UK, start by understanding what type of pension you have. Not all pensions are created equal, and how (or if) you transfer depends on the type:

Defined Contribution (DC) pensions (the most common):

These are your typical workplace and personal pensions.

You can usually transfer them to another DC scheme, SIPP, or even your new employer’s pension.

It’s relatively straightforward, but always check for:

Exit charges

Transfer fees

Lost benefits (like life insurance)

Defined Benefit (DB) pensions (final salary pensions):

These are less flexible and harder to transfer.

You’ll need regulated financial advice if the transfer value is over £30,000.

Transferring may mean giving up guaranteed income, which is a fixed amount of money that you receive regularly, usually monthly, from your pension. So, it’s a significant decision that should be made with a clear understanding of the potential trade-offs.

💡 Before transferring, knowing whether your pension is defined-contribution (DC) or defined-benefit (DB) is essential. The rules, flexibility, and potential risks are very different.

👉 Learn more from MoneyHelper’s guide to pension types

Book a 1:1 session for personalised guidance.

🔄 Should You Combine Old Pension Pots?

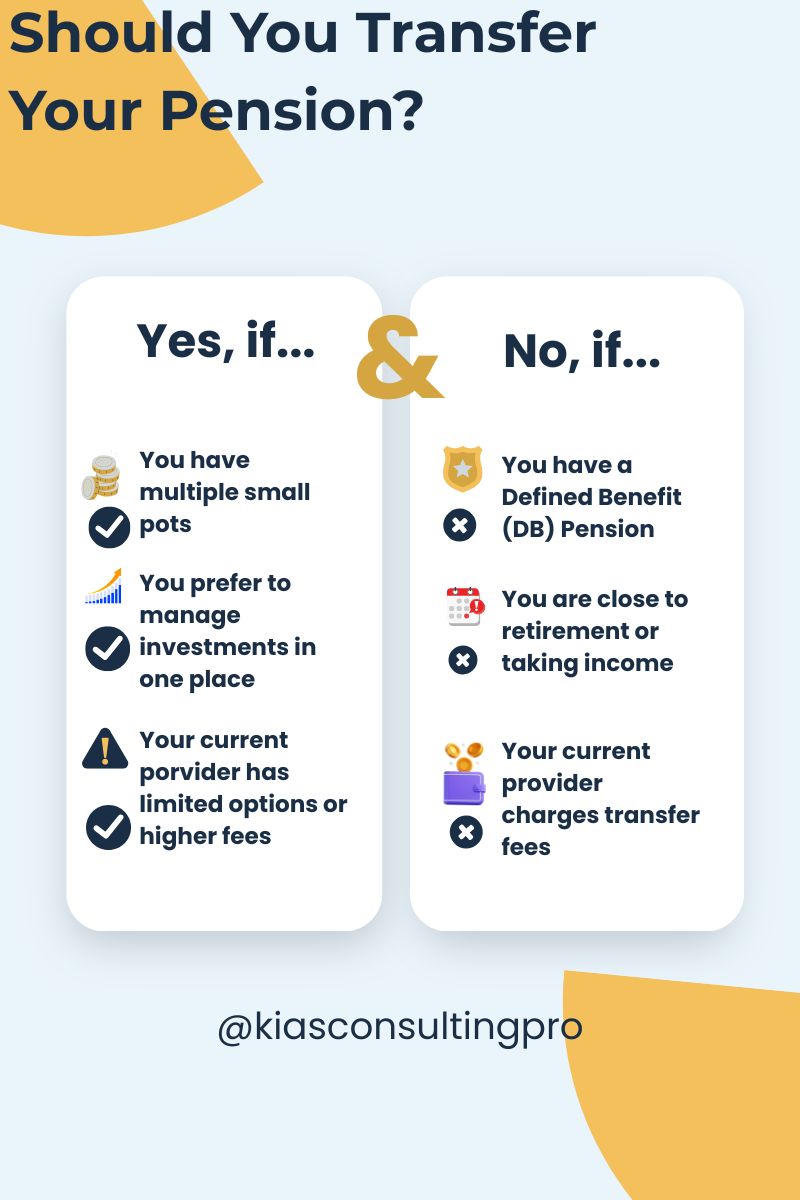

You may have several small pension pots if you’ve had multiple jobs. Combining (consolidating) pensions can make things easier to manage, but it’s not always the best option.

Pros of consolidating:

More straightforward to track your total retirement savings

Potentially lower fees

More investment choices

Cons:

You might lose valuable benefits (e.g. guaranteed annuity rates)

Exit fees could apply.

Risk of transferring to a provider with worse performance

👉 Use resources like MoneySavingExpert’s pension consolidation guide to decide what’s best.

💡 If your old pension pot is over £32,000, Vanguard offers a low-cost SIPP with no drawdown fees.

Prefer a flexible investing option? Try InvestEngine* — you and I both get up to £100 when you invest.

Disclosure: This is a referral link, and I may earn a reward if you sign up and invest.

🧾 What About Your New Employer’s Pension?

You’ll likely be automatically enrolled on your new employer’s pension scheme when you start a new job.

You can contribute to both your old and new pensions.

Your new employer will contribute to the new scheme.

You should receive welcome details and login info for your new pension account

💡 Check your contribution level — many employers match up to a certain % if you increase yours.

🏦 Can You Cash Out Your Pension When Leaving a Job?

Many people wonder about their pension when they change jobs in the UK, especially whether they can cash it out early. This is a popular question — and an important one:

🔸 If you’re under 55 (rising to 57 from 2028): You cannot cash out your pension, even if you’ve left your job.

🔸 After 55 (rising to 57 from 2028): You can access some or all of your pension, but it’s not always wise. Taking money early reduces your long-term income and may incur tax.

🚫 Avoid this myth: You cannot access a workplace pension early because you’ve left the company.

🔐 Can a Company Take Away Your Pension If You’re Fired?

No — your pension belongs to you, not the company.

Even if you’re fired or leave on bad terms:

The money already in your pension pot remains yours.

The company can’t touch it.

You may lose future contributions, but not what’s already saved

⚠️ Make sure your contact details are updated with your pension provider to keep tabs on your account.

💬 Can You Cash In a Pension from an Old Employer Before Age 55?

No, pensions are not like savings accounts. The money is locked away until the minimum access age:

55 (rising to 57 in 2028)

Exceptions are rare (e.g. serious ill health)

Trying to access your pension early via unofficial channels can lead to heavy tax penalties and scams.

✅ Instead: Focus on increasing current contributions and tracking your pots.

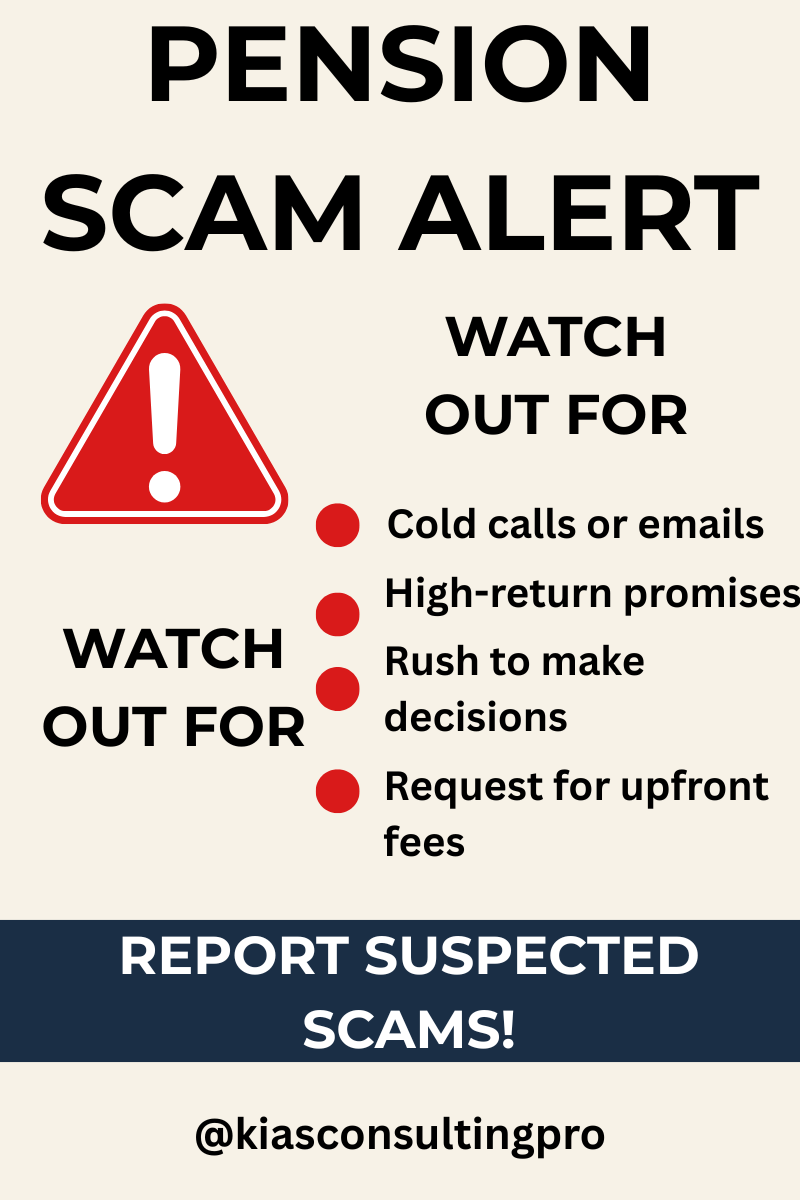

⚠️ Be Wary of Pension Scams

You may be more vulnerable to scammers when you leave a job or transfer pensions. Be cautious of anyone who:

Promises early access to your pension before age 55

Contacts you out of the blue about transferring your pension

Pressures you to act quickly

Always check if a firm is authorised via the FCA register and read MoneyHelper’s advice on pension scams.

🛡 Stay informed and never rush pension decisions.

🚨 How to Report a Pension Scam

If you suspect a pension scam or have been contacted by someone suspicious:

📞 Contact Action Fraud (the UK’s national reporting centre for fraud)

Or call 0300 123 2040🛡️ Report to the Financial Conduct Authority (FCA):

Use their ScamSmart reporting tool🔍 Check if a firm is authorised via the FCA Register

⚠️ Never transfer your pension or share personal details unless you’ve verified the company or adviser through official sources.

Would you like any help figuring out what to do with your pension?

Download our **free checklist by age** to see what steps to take in your 20s, 30s, 40s, 50s, or 60s.

📊 Summary: What to Do with Old Pensions

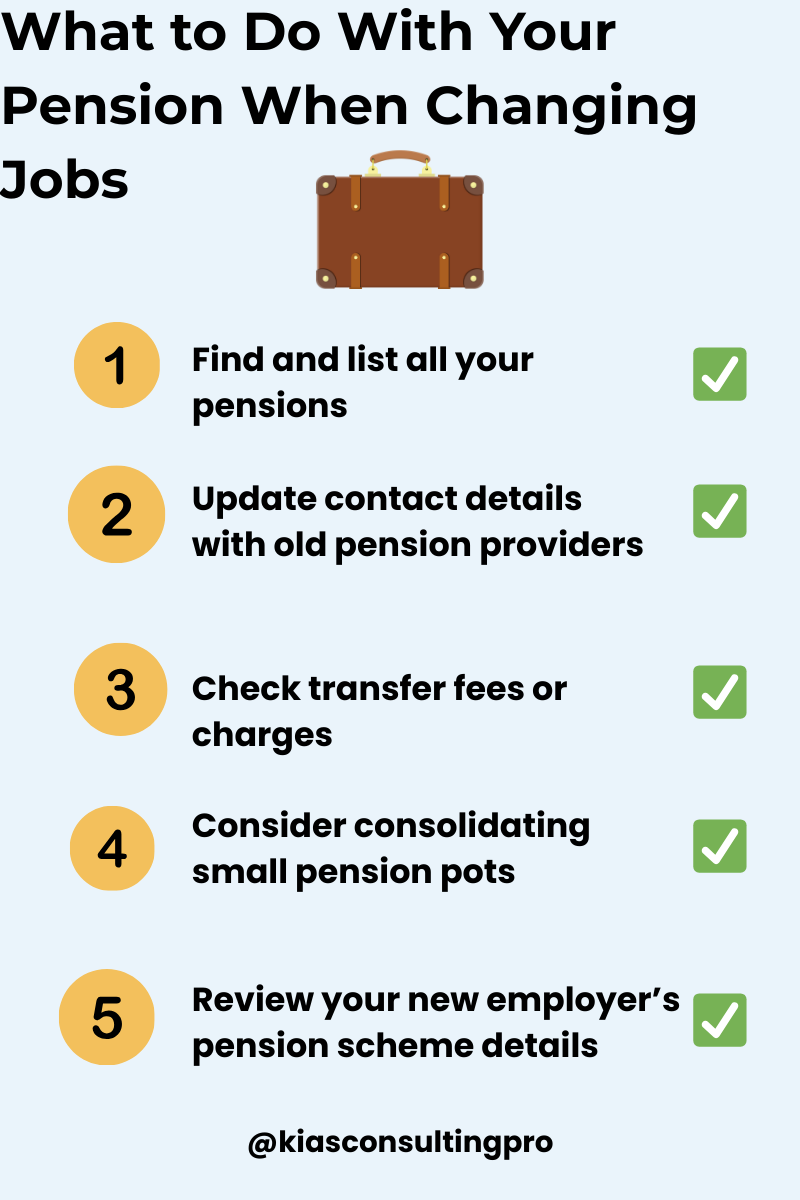

Managing your pension when you change jobs in the UK is easier when you follow these steps.

Checklist: Managing Your Pension When You Change Jobs UK

✅ Don’t lose track — make a list of all your pension pots

✅ Check their value and investment performance

✅ Decide whether to consolidate based on your goals

✅ Update contact details so you don’t miss key updates

✅ Start fresh with your new job by reviewing your contributions.

💼 What Do We Recommend?

Don’t ignore old pensions — they can add up over time, potentially growing into a significant part of your retirement savings if managed effectively.

You can use the Pension Tracing Service to find lost pots.

It’s crucial to update your contact details to ensure you don’t miss any key updates about your pensions.

Please continue contributing to your new pension as soon as possible.

If you’re unsure about any of these steps, don’t hesitate to speak to a regulated adviser. They can provide the guidance you need to make informed decisions about your pensions.

🧠 FAQs on Changing Jobs and Pensions

What happens to my pension when I change jobs in the UK?

Your pension pot stays in place and continues to grow, but your old employer stops contributing. You’ll start a new pension with your next employer.

Can I transfer my old workplace pension to a new job?

Yes. You can transfer to your new scheme or to a private pension — just make sure to check for exit fees or lost benefits.

Do I lose my pension if I’m fired?

No. The money already saved is yours. However, employer contributions will stop.

Can I take out my pension early if I leave my job?

Not unless you’re over 55 (57 from 2028) — early withdrawal is not allowed except in rare cases like ill health.

Can I have multiple pensions?

Yes, and many people do! You can track and manage them or consolidate them if appropriate.

➡️ What’s Next in the Pension Series?

In Part 6, we’ll answer the big question:

Can you retire early, and how can your pension help you do it?Ensure you’re subscribed by putting your details below, or check the Pension Series Hub to read it when it goes live!