Retiring early in the UK is a dream for many, but is it realistic? In this post, we’ll explore what early retirement means in the UK, the key things to consider, and how your pension can help make it a reality. Whether early retirement means stopping work entirely at 55, switching to part-time at 60, or reaching financial independence long before State Pension age, this guide is designed to give you precise, practical guidance to start planning.

Table of Contents

Toggle

What Does Early Retirement Mean in the UK?

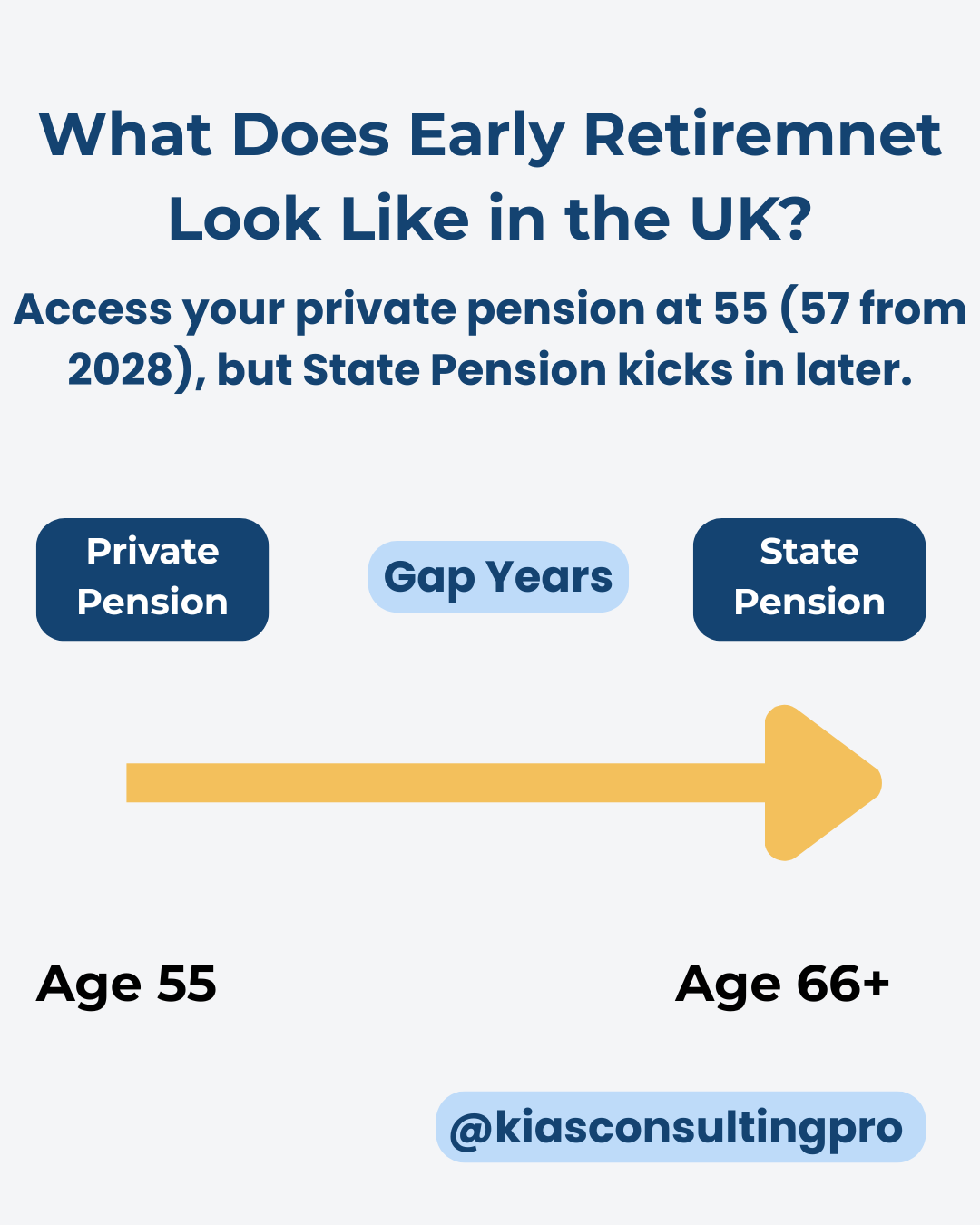

Early retirement in the UK means retiring before the State Pension age (currently 66 and rising). That might be age 55, 57, 60, or when you can financially step away from full-time work.

You can access private pensions (like personal pensions, SIPPs, or workplace pensions) from age 55 (rising to 57 in 2028), but you cannot access your State Pension until you reach the official age set by the government. If you want to retire early early in the UK, you’ll need to rely on your private pension and other savings to cover the gap.

✅ Learn how pensions work in the UK

Can You Afford to Retire Early in the UK?

This is the key question. To retire early, you’ll need to:

Estimate your annual living costs in retirement.

Work out how much income you’ll need before your State Pension kicks in.

You could check how much you have saved in pensions, ISAs, or other investments.

A helpful rule of thumb is the 4% rule—this suggests you can safely withdraw 4% of your pension pot each year without running out of money. So to generate £20,000 per year, you’d need around £500,000 saved. This means if you have £ 500,000 in your pension, you can withdraw 4% of this amount, which is £ 20,000, annually without depleting your pension fund.

📌 Use the MoneyHelper Pension Calculator to check your numbers

Real-Life Example: Emma’s Early Retirement Plan

Emma is 55 and wants to retire from full-time work. She has:

£240,000 in her pension, which she has been contributing to for the past 30 years

£60,000 in her Stocks & Shares ISA

A paid-off home

Emma plans to live on £20,000 yearly until her State Pension starts at 67. That’s 12 years = £240,000 needed. She uses her ISA for flexible income and gradually draws from her pension. With careful planning and a modest lifestyle, Emma retires early without financial stress.

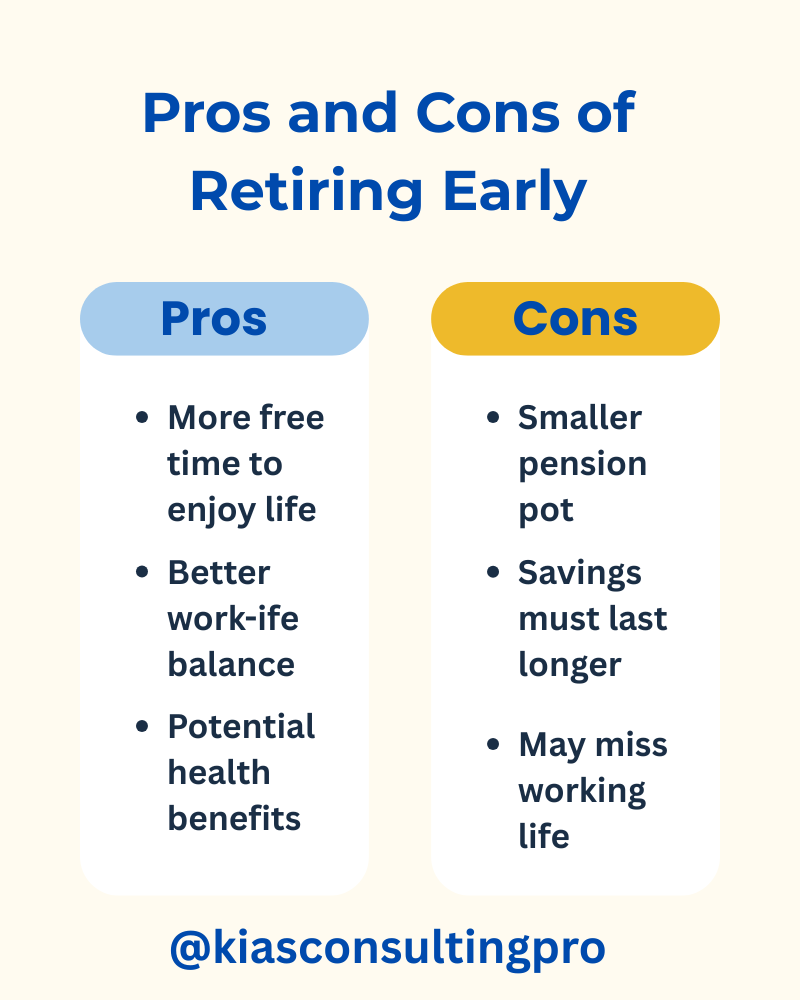

Pros and Cons of Retiring Early in the UK

Pros:

More time for hobbies, family, and personal projects

Better health in retirement (you retire while still active)

Opportunity to travel or change careers

Cons:

A longer retirement means needing more savings.

No access to the State Pension or some benefits until later

Your pension has less time to grow

How to Retire Early in the UK– Step-by-Step

Here’s a simple checklist:

Set your retirement age target (e.g. 55, 60, etc.)

Estimate annual expenses you’ll need

Add up your savings (pension, ISA, savings, other assets)

Use a retirement calculator to see if your pot is enough.

You could check if you have any pension gaps or missed contributions.

Make a top-up plan (e.g. increase pension/ISA savings now)

Plan for phased retirement (e.g. part-time work or freelancing)

✅ Check your State Pension forecast

Book a 1:1 session for personalised guidance.

Tips to Boost Your Early Retirement Plan in the UK

Increase pension contributions while working.

Consider a Stocks & Shares ISA for accessible, tax-free income.

Reduce debt and lower monthly expenses.

Delay accessing your pension if possible (which lets it grow)

Look into flexible drawdown options instead of taking a big lump sum

FAQs: Early Retirement in the UK

Can I retire at 55 with a pension?

Yes, you can access your workplace or personal pension at 55 (rising to 57). But the State Pension starts later.

Is retiring early realistic?

Yes, with good planning and savings. Many retire early by combining pensions, ISAs, and downsizing homes or changing careers.

Can I keep working part-time after retiring?

Absolutely. This is called phased retirement and can help you top up your pension.

Need help building your retirement plan? Book a free 30-minute strategy session to map it out together.

📘 Download your free

Pension Planning by Age Checklist: When to Review Your Pension by Age

Stay informed, stay empowered, and plan for the life you want!

Takeaway Summary: Can you Retire Early in the UK

You can retire early in the UK, but you’ll need to bridge the gap before your State Pension starts.

Aim for a retirement pot big enough to support 10–15+ years of income.

Use private pensions and ISAs wisely.

Plan early, review often, and adjust as needed.

💬 What About You?

Are you hoping to retire early—or already on the path to doing so?

Have you run your numbers or used any helpful tools?

👉 Share your thoughts or questions in the comments below.

Let’s start a conversation about what early retirement looks like for you.

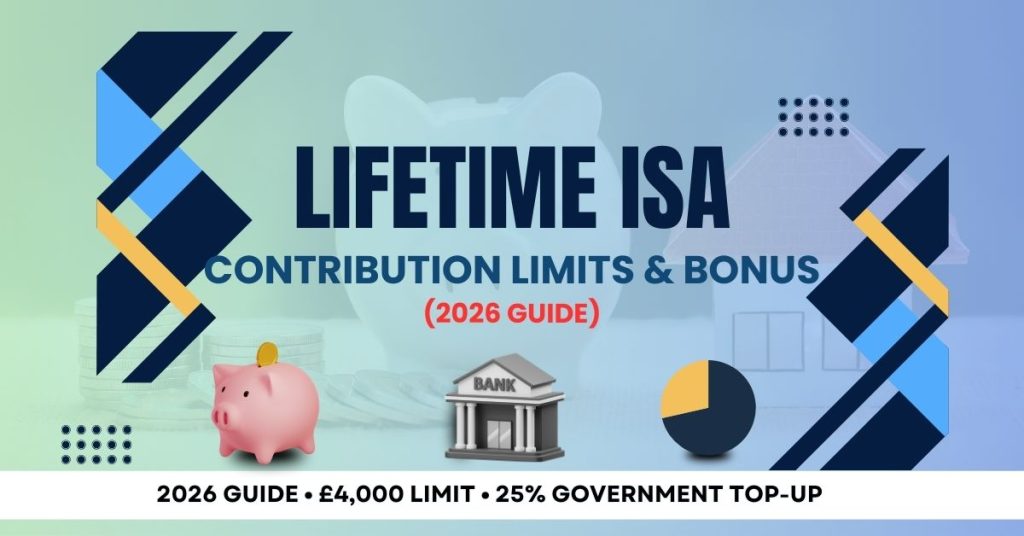

Lifetime ISA Contribution Limits and Bonus Explained (2026 Guide)

Understanding Lifetime ISA contribution limits is crucial for maximising your savings in 2026. The annual limit of £4,000 determines how much government bonus you’ll receive—making it one of the most important aspects of your LISA strategy.

In this comprehensive guide, we explain everything you need to know about LISA contribution limits, including how the £4,000 annual cap works, how it fits within your overall £20,000 ISA allowance, and what happens if you contribute too much.

We’ll also explore practical strategies like monthly versus lump sum contributions, when to contribute for maximum growth, and how to coordinate your LISA with other ISAs. Plus, learn about the 2026 Budget update confirming limits remain frozen until 2031.

Whether you’re saving for your first home or planning for retirement, this guide will help you make the most of your Lifetime ISA contribution allowance and maximise your government bonus.

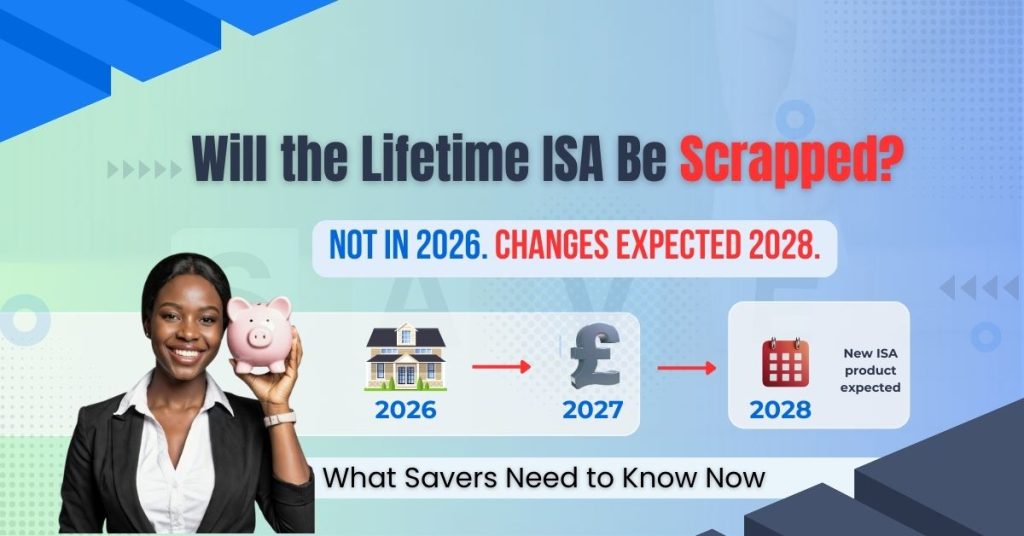

Will the Lifetime ISA Be Scrapped? Everything We Know About the 2028 Changes

Is the Lifetime ISA being scrapped? Learn what the proposed 2028 changes mean, what stays the same, and how to protect your bonus, retirement options, and home-buying plans.

Hargreaves Lansdown Fee Changes March 2026: What You Really Need to Know

A 515-character summary explaining the key changes (0.45% → 0.35% platform fees, new £1.95 fund charge) and positioning the article as a guide to help readers calculate their impact and decide whether to stay or switch.

Capital Gains Tax on Property in the UK (2025/26)

Capital gains tax on property in the UK can apply when selling a buy-to-let, second home, or inherited property. This 2025/26 guide explains the rules, Private Residence Relief, allowable costs, and the 60-day reporting deadline.

How to Reduce Capital Gains Tax Legally in the UK (2025/26): 10 Strategies That Can Help

Learn how to reduce Capital Gains Tax legally in the UK for 2025/26. 10 practical CGT strategies, clear examples, and a free CGT calculator.

Capital Gains Tax UK: How Much Will You Pay When You Sell an Asset?

Capital Gains Tax can apply when you sell property, shares, or crypto in the UK. This guide explains how CGT works and helps you estimate what you might owe before you sell.

How to Build Your Credit Score in the UK (2026): Cards, Apps & Smart Money Habits

A practical 2026 guide on how to build your credit score in the UK using credit cards, apps and smart money habits, without damaging your finances.

Investment Fees Explained: The Real Cost of Investing (and How to Pay Less in 2025)

Investment fees can quietly shrink your long-term returns. This simple UK guide explains the main types of fees, how they affect your portfolio, and practical ways to reduce costs in 2025 so more of your money stays invested for your future.

FSCS Protection UK: How to Keep Your Money Safe in 2025

FSCS protection in the UK is changing from 1 December 2025. The standard deposit limit will rise from £85,000 to £120,000, and temporary high balances will be protected up to £1.4 million. This guide explains how the new limits work and how to keep your money safe across banks, savings apps and investment platforms.

How to Budget for Christmas Gifts Without Overspending (UK 2025 Guide)

Christmas is one of the most expensive times of the year, but overspending doesn’t have to be your story. This guide shows you how to budget for Christmas gifts in the UK, use cashback and discounted gift cards, avoid borrowing, and give meaningfully without going broke. Practical, simple, and perfect for helping you stay debt-free this festive season.

Achieve Financial Independence in the UK: 7 Proven Tips (Plus a Mortgage Strategy That Works in 2025)

Practical, UK-focused financial independence tips for 2025. Learn how to budget, invest, and build multiple income streams to achieve lasting financial freedom.

Master Your Money in 2025: A Complete Guide to Budgeting and the Best Tools That Actually Work

Find the best budgeting tools and planners to master your money in 2025. Learn how to create a budget that works for you using digital planners, binders, and smart budgeting systems.