Retiring early in the UK is a dream for many, but is it realistic? In this post, we’ll explore what early retirement means in the UK, the key things to consider, and how your pension can help make it a reality. Whether early retirement means stopping work entirely at 55, switching to part-time at 60, or reaching financial independence long before State Pension age, this guide is designed to give you precise, practical guidance to start planning.

Table of Contents

Toggle

What Does Early Retirement Mean in the UK?

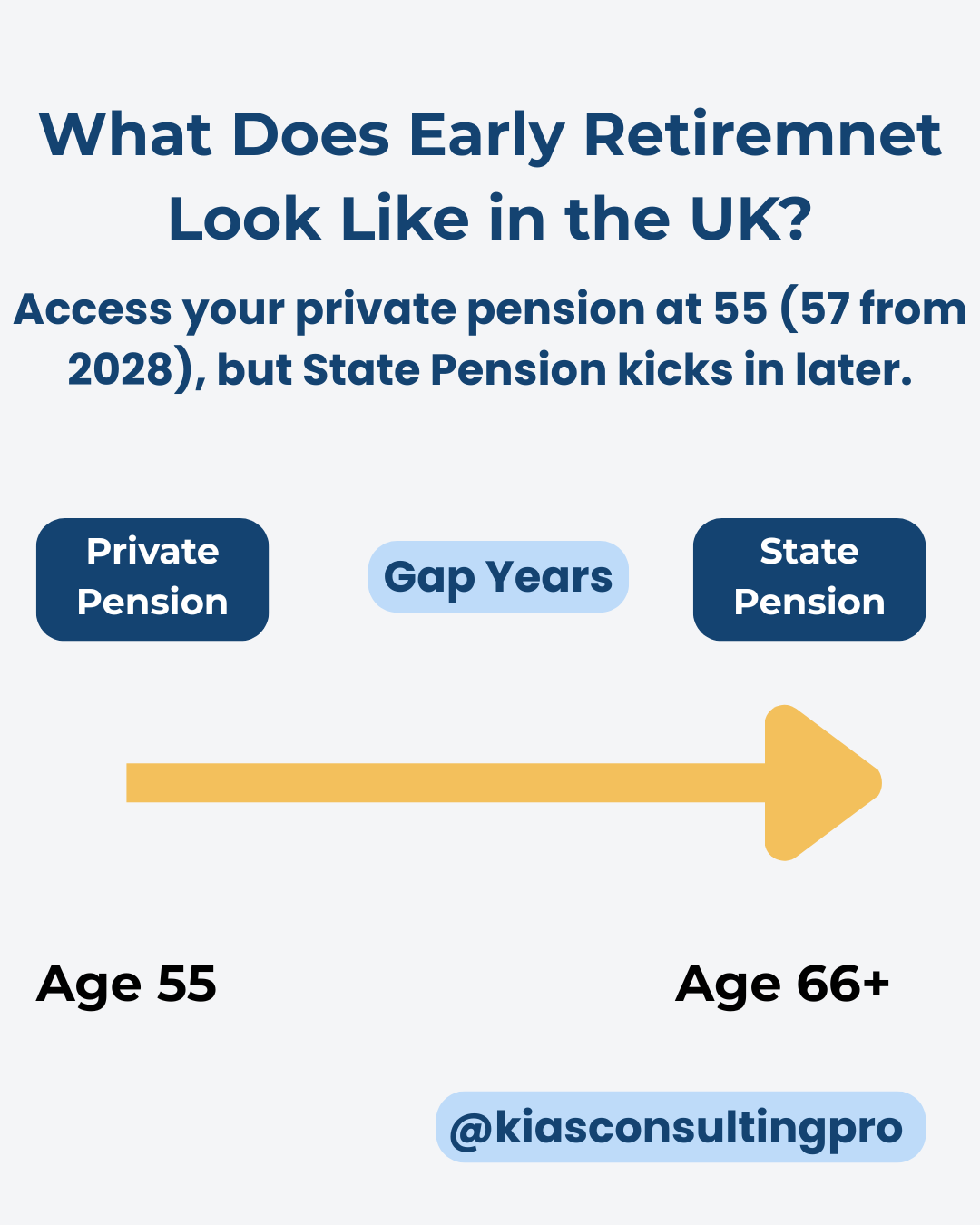

Early retirement in the UK means retiring before the State Pension age (currently 66 and rising). That might be age 55, 57, 60, or when you can financially step away from full-time work.

You can access private pensions (like personal pensions, SIPPs, or workplace pensions) from age 55 (rising to 57 in 2028), but you cannot access your State Pension until you reach the official age set by the government. If you want to retire early early in the UK, you’ll need to rely on your private pension and other savings to cover the gap.

✅ Learn how pensions work in the UK

Can You Afford to Retire Early in the UK?

This is the key question. To retire early, you’ll need to:

Estimate your annual living costs in retirement.

Work out how much income you’ll need before your State Pension kicks in.

You could check how much you have saved in pensions, ISAs, or other investments.

A helpful rule of thumb is the 4% rule—this suggests you can safely withdraw 4% of your pension pot each year without running out of money. So to generate £20,000 per year, you’d need around £500,000 saved. This means if you have £ 500,000 in your pension, you can withdraw 4% of this amount, which is £ 20,000, annually without depleting your pension fund.

📌 Use the MoneyHelper Pension Calculator to check your numbers

Real-Life Example: Emma’s Early Retirement Plan

Emma is 55 and wants to retire from full-time work. She has:

£240,000 in her pension, which she has been contributing to for the past 30 years

£60,000 in her Stocks & Shares ISA

A paid-off home

Emma plans to live on £20,000 yearly until her State Pension starts at 67. That’s 12 years = £240,000 needed. She uses her ISA for flexible income and gradually draws from her pension. With careful planning and a modest lifestyle, Emma retires early without financial stress.

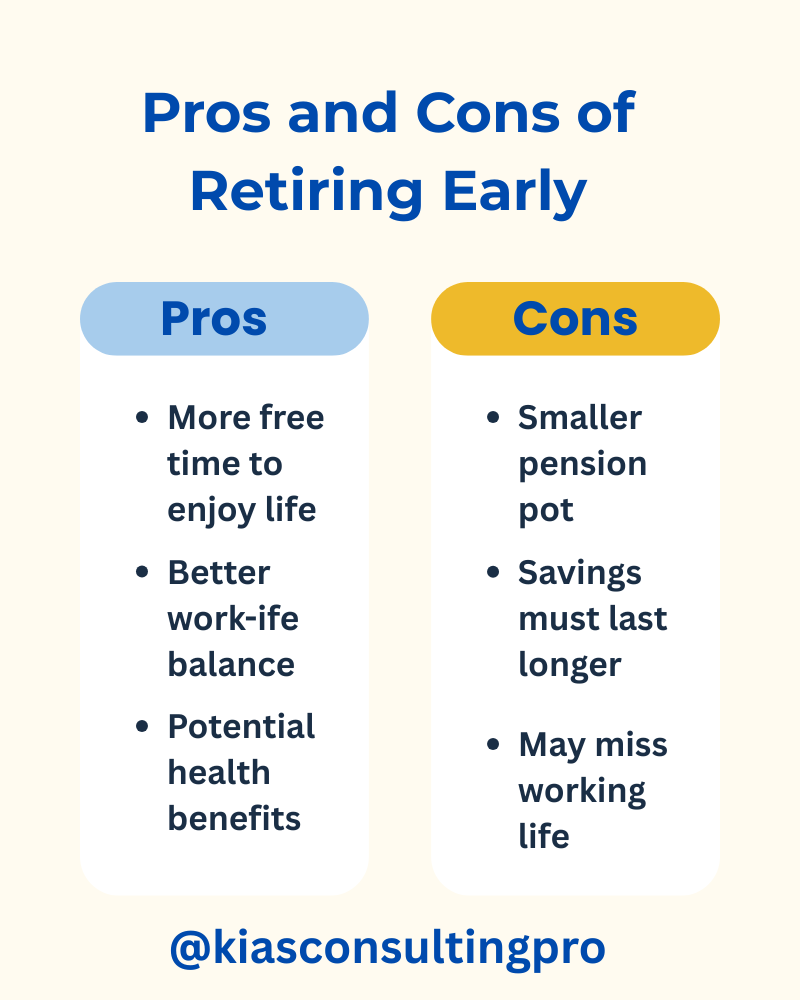

Pros and Cons of Retiring Early in the UK

Pros:

More time for hobbies, family, and personal projects

Better health in retirement (you retire while still active)

Opportunity to travel or change careers

Cons:

A longer retirement means needing more savings.

No access to the State Pension or some benefits until later

Your pension has less time to grow

How to Retire Early in the UK– Step-by-Step

Here’s a simple checklist:

Set your retirement age target (e.g. 55, 60, etc.)

Estimate annual expenses you’ll need

Add up your savings (pension, ISA, savings, other assets)

Use a retirement calculator to see if your pot is enough.

You could check if you have any pension gaps or missed contributions.

Make a top-up plan (e.g. increase pension/ISA savings now)

Plan for phased retirement (e.g. part-time work or freelancing)

✅ Check your State Pension forecast

Book a 1:1 session for personalised guidance.

Tips to Boost Your Early Retirement Plan in the UK

Increase pension contributions while working.

Consider a Stocks & Shares ISA for accessible, tax-free income.

Reduce debt and lower monthly expenses.

Delay accessing your pension if possible (which lets it grow)

Look into flexible drawdown options instead of taking a big lump sum

FAQs: Early Retirement in the UK

Can I retire at 55 with a pension?

Yes, you can access your workplace or personal pension at 55 (rising to 57). But the State Pension starts later.

Is retiring early realistic?

Yes, with good planning and savings. Many retire early by combining pensions, ISAs, and downsizing homes or changing careers.

Can I keep working part-time after retiring?

Absolutely. This is called phased retirement and can help you top up your pension.

Need help building your retirement plan? Book a free 30-minute strategy session to map it out together.

📘 Download your free

Pension Planning by Age Checklist: When to Review Your Pension by Age

Stay informed, stay empowered, and plan for the life you want!

Takeaway Summary: Can you Retire Early in the UK

You can retire early in the UK, but you’ll need to bridge the gap before your State Pension starts.

Aim for a retirement pot big enough to support 10–15+ years of income.

Use private pensions and ISAs wisely.

Plan early, review often, and adjust as needed.

💬 What About You?

Are you hoping to retire early—or already on the path to doing so?

Have you run your numbers or used any helpful tools?

👉 Share your thoughts or questions in the comments below.

Let’s start a conversation about what early retirement looks like for you.

Master Your Money in 2025: A Complete Guide to Budgeting and the Best Tools That Actually Work

Find the best budgeting tools and planners to master your money in 2025. Learn how to create a budget that works for you using digital planners, binders, and smart budgeting systems.

The Truth About InvestEngine – My UK Review After 1 Year (2025)

I transferred my Vanguard SIPP to InvestEngine – and it wasn’t smooth sailing. Here’s my honest 2025 review of the platform after a full year of use, including why I’m giving them a second chance.

The Ultimate List of 7 Best Investing Books for Beginners (2025 Edition)

Discover the best investing books for beginners in 2025, seven timeless reads that simplify wealth-building, explain core investing principles, and help you start your journey toward financial independence with confidence.

How to Raise a Complaint to the UK Financial Ombudsman (With Real-Life Example)

I raised a complaint with the UK Financial Ombudsman when my SIPP transfer went wrong, and won. Here’s what happened, how the process works, and how to raise your own complaint with confidence.

The Smart Investor’s Secret: How ISAs Can Grow Your Wealth Tax-Free

ISAs remain one of the UK’s best-kept tax-free saving secrets. Discover how ISAs can grow your wealth tax-free and why starting early gives your money more time to compound. Whether you prefer saving or investing, learn how to make the most of your ISA in 2025 and beyond.

How to Switch Bank Accounts Safely (CASS Explained)

Want to switch bank accounts in the UK without stress? Learn how CASS works step-by-step, the protections built in, and smart tips to avoid mistakes.

Government & Free Debt Reduction Help in the UK: What Really Works (2025 Guide)

Debt doesn’t have to control your future. Discover government and free debt reduction help in the UK, including DROs, Breathing Space, and StepChange.

UK Bank Switching 2025: The Best Easy Direct Debit Options

Looking to grab a UK bank switching bonus in 2025 but don’t have enough bills to set up the required direct debits? Don’t worry, there are quick, low-cost “dummy” options that work just as well. From £1 charity donations to Plum’s weekly depositor and PayPal direct debits, this guide walks you through the easiest ways to qualify, step by step, without breaking the bank.

The Power of Compound Interest: How Small Savings Grow into Big Wealth

Compound interest is often called the “eighth wonder of the world.” Discover how it works, the importance of starting early, and how to integrate it into your UK savings and investment strategy.

Best UK Bank Switching Offers 2025 (and How to Qualify)

Looking to cash in on the best UK bank switching offers for 2025? This guide covers the top bonuses from TSB, Barclays, NatWest, HSBC, and more, plus tips on eligibility, dummy accounts, and tracking your rewards with my free Debt Tracker Toolkit.

How to Earn £310 in UK Switching Bonuses Using a Dummy Account

Looking to cash in on the best UK bank switching offers for 2025? This guide covers the top bonuses from TSB, Barclays, NatWest, HSBC, and more, plus tips on eligibility, dummy accounts, and tracking your rewards with my free Debt Tracker Toolkit.

Best Savings Accounts UK (October 2025): Top Rates Now

Best savings accounts UK (Aug 2025): Following the Bank Rate cut to 4.00%, this guide highlights today’s top easy-access, Cash ISA, notice and fixed options. It explains a drip-feed strategy (lump sum + regular saver) and PSA vs ISA tips so you keep more of your interest, tax-efficiently.