Do you know how much your State Pension forecast in the UK for 2025/26 is? If you’re working and paying National Insurance (NI), it’s worth finding out, and it’s a straightforward process that takes only a few minutes.

Table of Contents

Toggle

Your State Pension forecast tells you:

- How much you’re likely to get

- When you’ll get it

- Whether you have gaps in your record that could affect your pension

Understanding your retirement income is not just crucial; it’s empowering, especially if you want to plan confidently.

📅 This is Part 4 of our UK Pension Series. We recommend catching up on the other parts to ensure you’re fully informed and prepared.

In this guide, we’ll show you exactly how to check your forecast, what the results mean, and how to boost your State Pension if needed.

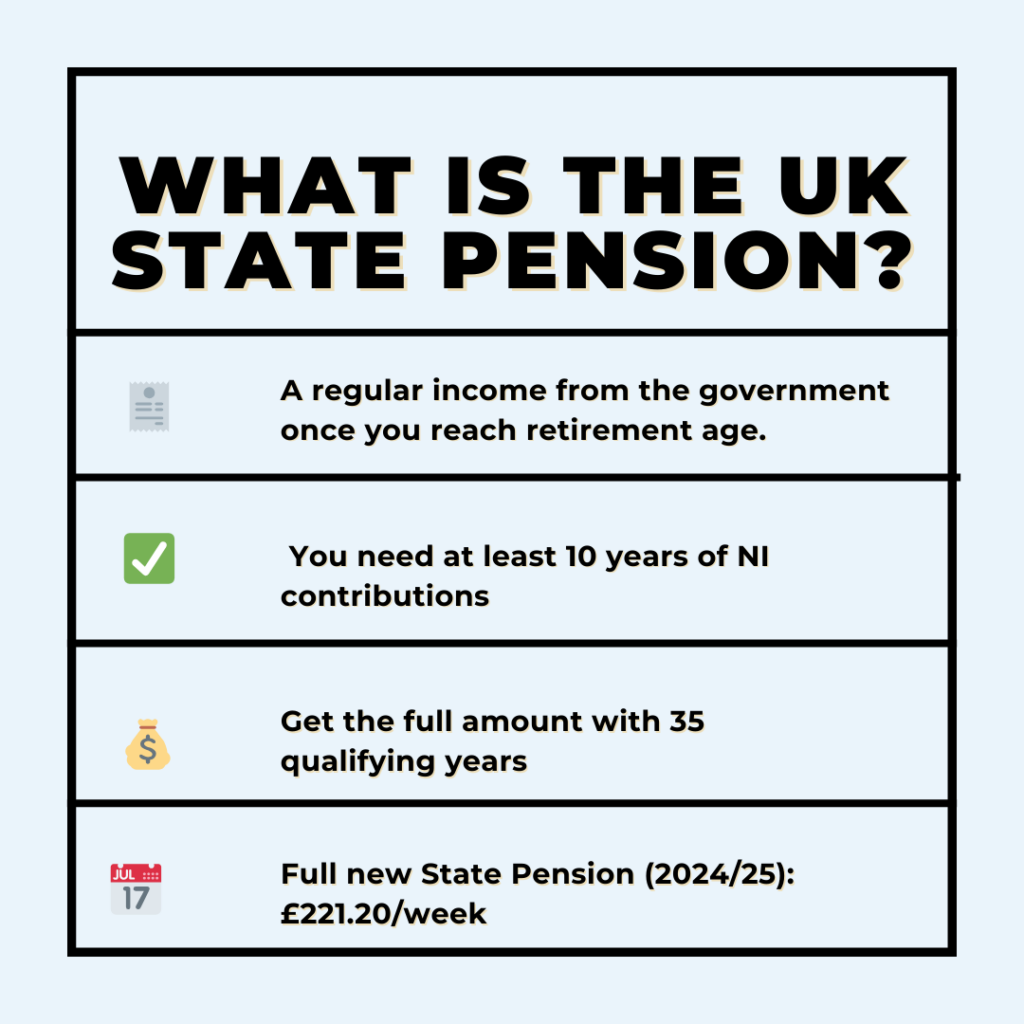

What Is the UK State Pension?

The State Pension is a regular payment you can receive from the government once you reach the State Pension age, currently 66. It’s designed to provide a foundation for your retirement income.

📅 As of April 2025, the full new State Pension is £230.25 per week or £11,973 per year.

You need 35 qualifying years of National Insurance (NI) contributions to receive the full amount. You need at least 10 years to get anything at all.

Why You Should Check Your Forecast

Your State Pension Forecast UK 2025/26 gives you the most up-to-date projection of your entitlement based on your NI record. Many assume they’ll automatically qualify for the full pension, but your actual amount depends on your NI record. Checking your forecast allows you to:

- See how much you’re currently on track to receive.

- You can find out your exact state pension

- Discover if you have gaps in your NI record that could reduce your entitlement

How to Check Your State Pension Forecast

1. Go to the official GOV.UK State Pension Forecast page

2. You could sign in with your Government Gateway account or create one.

3. Review your projected pension and NI record

💡 Your forecast will show you:

- The amount you're likely to get at retirement

- Your current number of qualifying NI years

- Whether you're eligible to fill in any gaps

Can You Boost Your Forecast?

Yes! If you’re not on track for the full pension, there are a few ways to improve it:

1. Fill NI Gaps

If you’ve missed years due to unemployment, career breaks, or self-employment, you may be able to:

- Pay Voluntary NI Contributions

- Claim NI credits if you were eligible for certain benefits (e.g. Child Benefit, Jobseeker’s Allowance)

📌 Important update for 2025/26: The special deadline of 5 April 2025, you could top up gaps going back to 2006 has now passed. From April 2025 onwards, you can only fill gaps for the past 6 tax years.

2. Continue Working

Working past the State Pension age or into your 60s can help you accumulate more qualifying years. Even part-time income can contribute.

3. Defer Your Pension

You don’t have to claim your State Pension once you reach retirement age. Deferring could increase your weekly payments over time.

What If You’re Self-Employed?

If you’re self-employed, you’re likely paying Class 2 NI contributions, which still count toward your State Pension. But it’s essential to:

- You could check your contribution status.

- Top up any missing years if your income was low.

- Consider voluntary contributions if you weren’t required to pay NI

Planning Beyond the State Pension

The State Pension isn’t meant to be your only source of income. In 2025/26, it provides £997.75/month (£11,973/year), which is well below what most people need for a comfortable retirement. According to the PLSA’s 2025 Retirement Living Standards, a single person needs £13,400/year for a minimum lifestyle, £31,700/year for a moderate retirement, and £43,900/year for a comfortable one. Even the State Pension alone falls short of the minimum standard, making private savings/pension essential.

Combine it with workplace pensions, personal pensions, ISAs, and other savings to create a well-rounded retirement plan.

Action Steps

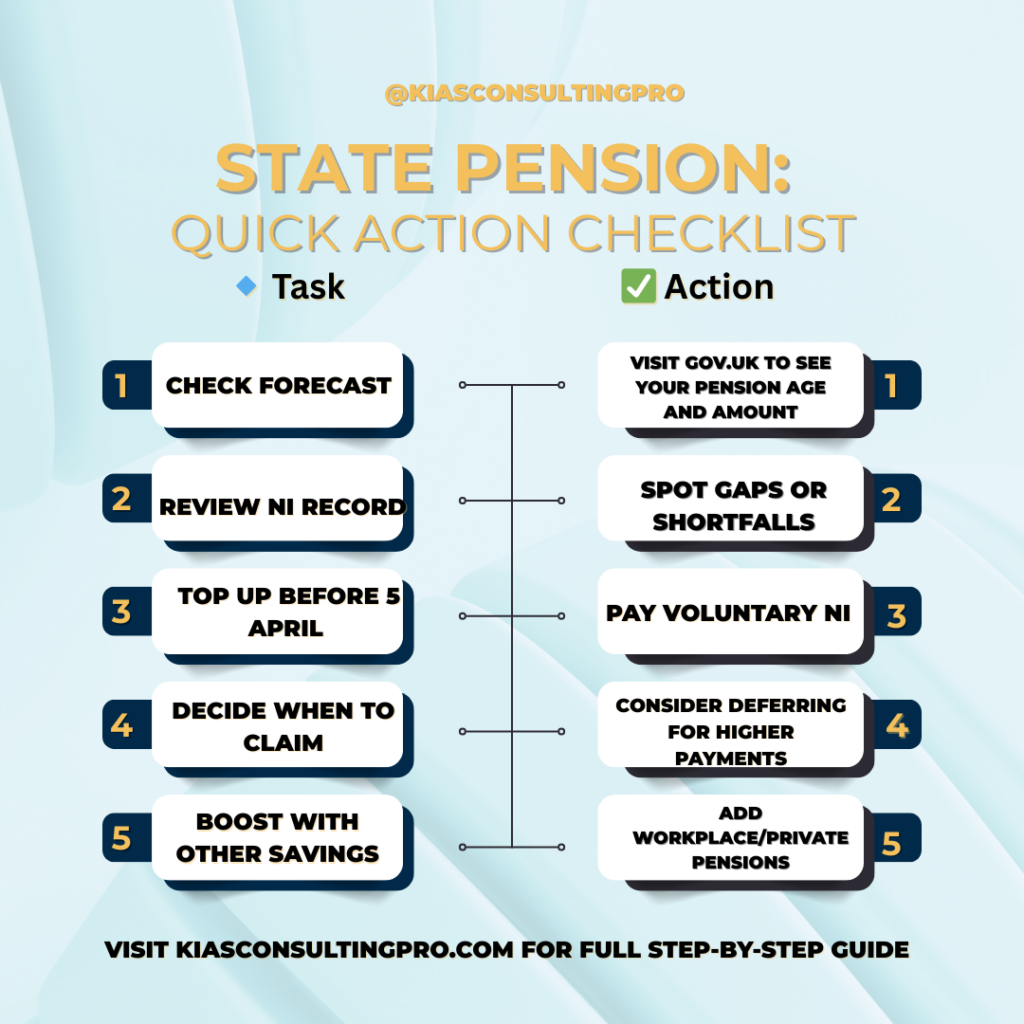

Quick Checklist: Your State Pension To-Dos

0 of 5 completed

- Review your State Pension forecast UK 2025/26 to make informed choices about your retirement timeline. Updated

- Review your National Insurance record.

- Note your current entitlement and the years still needed.

- Consider topping up or claiming NI credits if you have gaps.

- Use your forecast as part of your wider retirement planning.

Click each item as you complete it

📩 Join our newsletter to get weekly retirement tips and guides straight to your inbox.

👀 Explore the full UK Pension Series for even more support.

Get the Budget Planner