Table of Contents

Toggle

📈 Investing Notice: This content is for informational purposes only and not investment advice. Investments can go up and down in value. Always do your own research and seek advice from a regulated professional. See full disclaimer.

Are you considering starting your investment journey and wondering if *Trading 212 is the right platform for you? In this Trading 212 review UK, I’ll break down exactly how the app works, its features, fees, and whether it’s the best choice for beginners looking for a commission-free investing experience.

That’s why I’m here to guide you through and help you figure out if Trading 212 is the right fit for you.

In this Trading 212 review UK, I’ll walk you through their user-friendly features, such as Pies and AutoInvest, and explain how they manage dividends and fees in straightforward, jargon-free terms. By the end, you’ll have a clear understanding of whether Trading 212 is a good match for your investment objectives.

What Exactly is Trading 212? | Trading 212 Review UK

*Trading 212 was launched in 2004 and has quickly grown to become one of the UK’s most popular investment platforms, with over two million users worldwide. It’s primarily known for commission-free investing, meaning you won’t pay hidden fees when buying or selling stocks and ETFs.

They provide three main account options:

- Invest Account: Standard investing in stocks and ETFs, ideal if you’ve already used up your ISA allowance.

- ISA Account: A tax-efficient option specifically for UK residents, allowing you to invest without annual fees.

- CFD Account: Higher-risk leveraged trading, generally recommended only for experienced traders.

For most beginners and everyday investors, the ISA account is typically the perfect choice. For more information, check out my detailed guide on investing on Trading 212.

Is Trading 212 Safe?

Safety should always be a priority when choosing an investment platform. The good news is that Trading 212 is regulated in the UK by the Financial Conduct Authority (FCA). Your money is held securely in segregated accounts and protected by the Financial Services Compensation Scheme (FSCS) up to £85,000.

Standout Features of Trading 212 for UK Investors

Fractional Shares: Invest from Just £1

One feature I genuinely love about *Trading 212 is fractional shares. You don’t need large amounts of money to invest in expensive stocks like Amazon or Tesla. With just £1, you can own a small part of these major companies and steadily build your portfolio.

Pies & AutoInvest: Simplify Your Investments

Trading 212’s Pies and AutoInvest are some of their best features for beginner investors.

Think of pies as personalised investment baskets—you pick your favourite stocks or ETFs and assign each a specific percentage. Trading 212 then automatically manages and invests your money according to your preferences. It’s an intuitive tool perfect for stress-free, automated investing.

Dividend Investing Made Simple

If you enjoy the idea of getting regular income from your investments, Trading 212 makes dividend investing easy. Dividends from stocks you own are automatically credited to your account. Thanks to fractional shares, even small dividends can be reinvested right away, boosting your portfolio growth.

For more on dividends, check out my easy-to-follow guide on how to invest in UK stocks.

Understanding Trading 212 Fees and Charges | Trading 212 Review UK

Here’s what you need to know about fees:

Commissions: Absolutely free for buying or selling stocks and ETFs.

Account Fees: None for Invest or ISA accounts, meaning no unexpected monthly charges.

Foreign Exchange Fees: A low fee of just 0.15% when trading international stocks.

Clearly, the Trading 212 fee structure is highly competitive compared to other platforms, such as Freetrade and Vanguard.

Trading 212 vs Competitors

Let’s quickly compare Trading 212 to other popular platforms:

| Feature | *Trading 212 | Freetrade | Vanguard |

|---|---|---|---|

| Commissions | Free | Free | Free (for Vanguard funds) |

| ISA Account Fees | Free | £4.99/month | 0.15% annually (with a maximum charge of £375 per year for larger portfolios, or a flat £4 per month for smaller portfolios) |

| FX Fees | 0.15% | 0.59% | N/A (UK-based funds only) |

| Unique Features | Pies, AutoInvest | Simple interface, basic recurring investments | Pension accounts, Junior ISAs, focused on funds |

Trading 212 clearly offers excellent value, especially for beginners who want an intuitive investing experience.

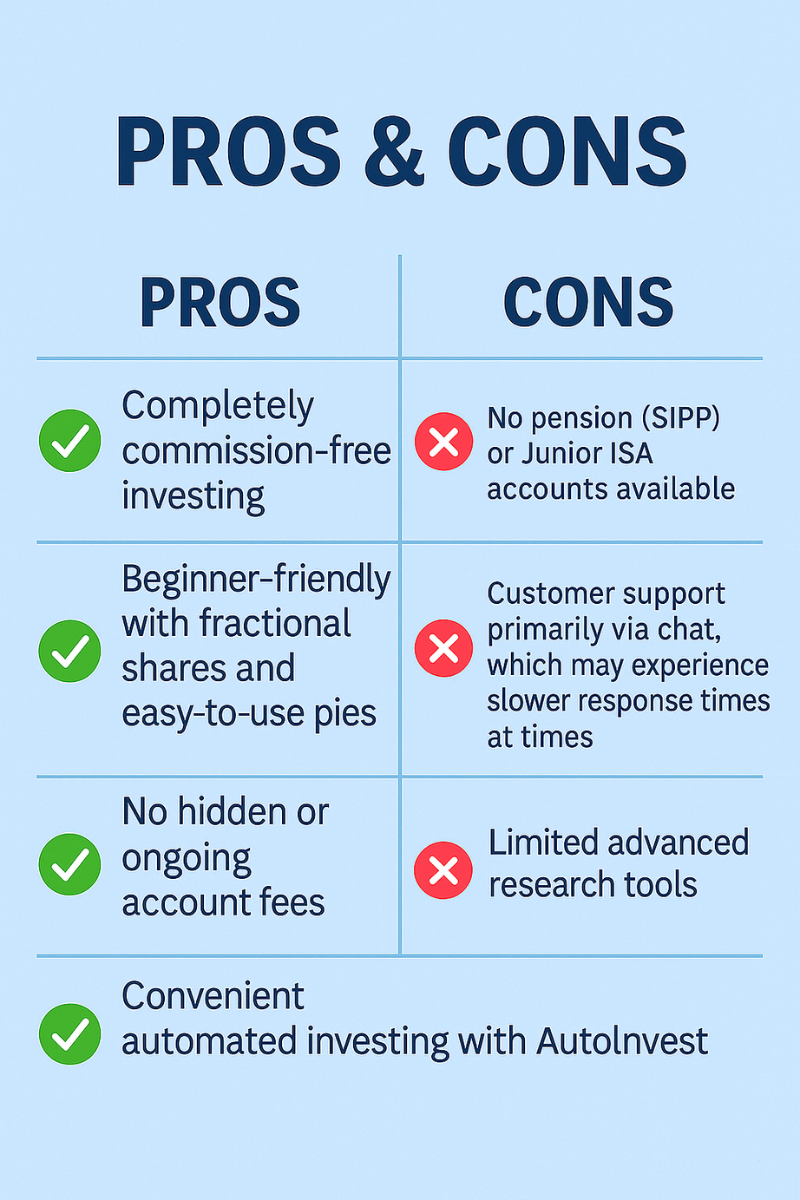

Pros and Cons of Using Trading 212 in the UK

Pros:

Completely commission-free investing.

Beginner-friendly with fractional shares and easy-to-use pies.

No hidden or ongoing account fees.

Convenient automated investing with AutoInvest.

Cons:

No pension (SIPP) or Junior ISA accounts available.

Customer support is primarily available via chat, which may experience slower response times at times.

Limited advanced research tools.

My Personal Experience

As a financial coach, I’ve seen firsthand how Trading 212’s simplicity and helpful features can empower new investors. The ease of use, combined with features like fractional shares and pies, helps my clients feel confident and supported as they start investing.

Ready to explore your own investment strategy? Book a free coaching session with me today.

FAQs about Trading 212

Q: Is Trading 212 truly commission-free?

Yes, it’s completely commission-free for stocks and ETFs.

Q: How does Trading 212 earn money?

Primarily through small FX conversion fees, interest from cash balances, and fees from CFD trading accounts.

Q: Is Trading 212 safe and trustworthy?

Absolutely. It's regulated by the FCA, and your money is FSCS-protected up to £85,000.

Q: Is it suitable for beginners?

Definitely. Its simple, intuitive design and fractional shares option make it ideal for new investors.

Final Thoughts: Is Trading 212 the Right Choice for You?

In conclusion, this Trading 212 review UK highlights how the platform ticks many boxes for new investors seeking a straightforward, affordable, and secure investing experience.

Whether you’re investing for the first time or optimising your existing portfolio, Trading 212 provides everything you need to meet your financial goals.

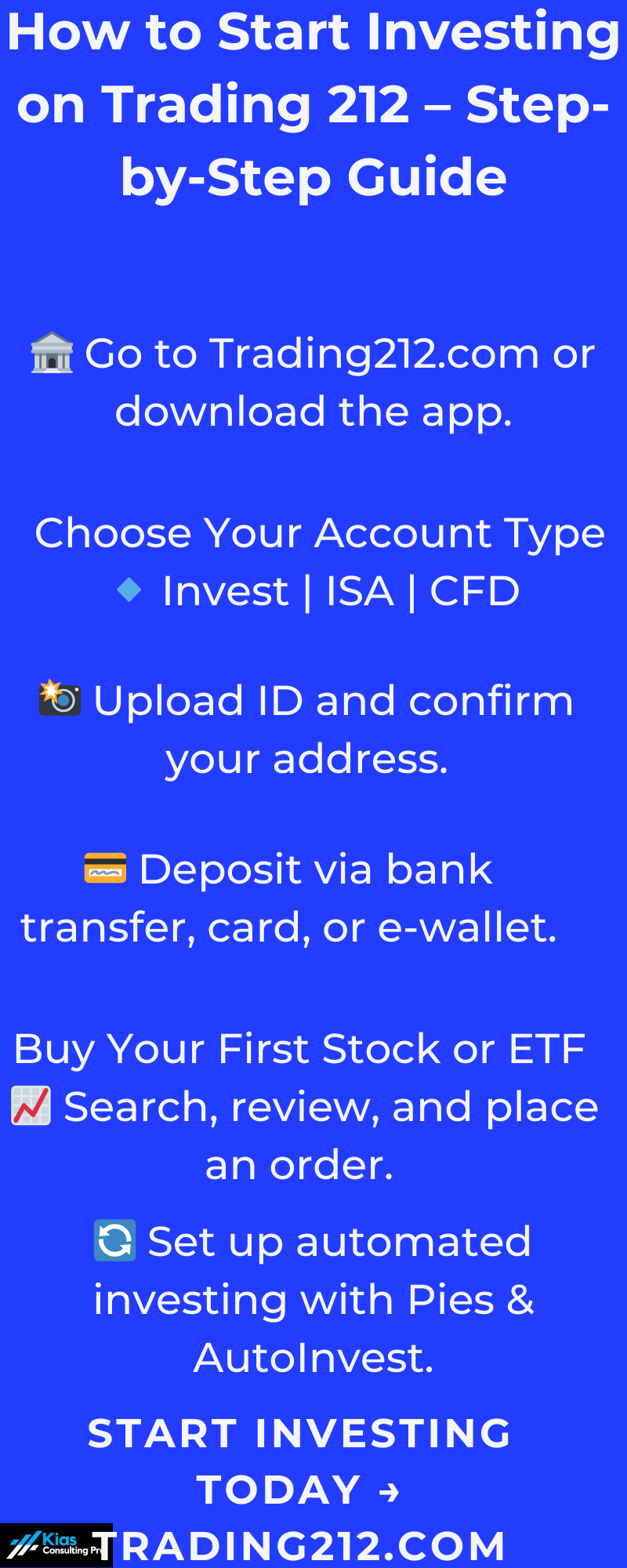

Want to learn more about getting started? Check out my detailed step-by-step guide to investing on Trading 212.

Happy investing!

Workshops Coming Soon

Stay ahead of the curve by joining our waitlist! You’ll receive early access to upcoming workshop dates and exclusive financial resources tailored just for you.

Sign up today to take the first step toward building financial confidence.

Join The Waitlist Now!

New to Investing on Trading212?

Follow this step-by-step guide to start investing on Trading 212 today!